Question: 4/ help out Using the simplified method, determine the tax-free amount of the following distributions from a qualified pension plan. Individual contributions, if any, are

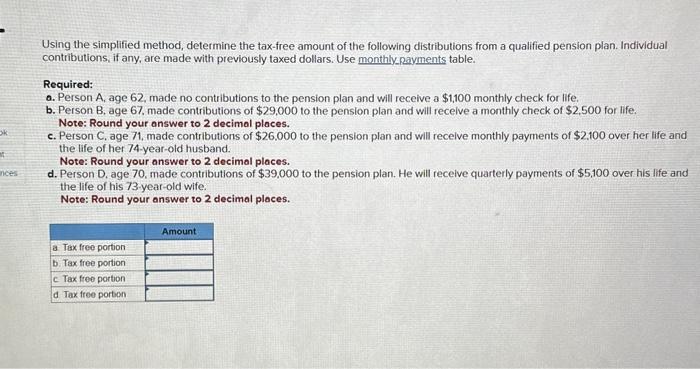

Using the simplified method, determine the tax-free amount of the following distributions from a qualified pension plan. Individual contributions, if any, are made with previously taxed dollars. Use monthlycravments table. Required: a. Person A, age 62, made no contributions to the pension plan and will receive a $1,100 monthly check for life. b. Person B, age 67 , made contributions of $29,000 to the pension plan and will recelve a monthly check of $2,500 for life. Note: Round your answer to 2 decimal places. c. Person C. age 71 , made contributions of $26.000 to the pension plan and will recelve monthly payments of $2.100 over her life and the life of her 74-year-old husband. Note: Round your answer to 2 decimal places. d. Person D, age 70 , made contributions of $39,000 to the pension plan. He will recelve quarterly payments of $5,100 over his life and the life of his 73 -year-old wife. Note: Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts