Question: 4. How do coupon bonds work? 1 point You purchase a bond for one price, but the final price you may sell it for depends

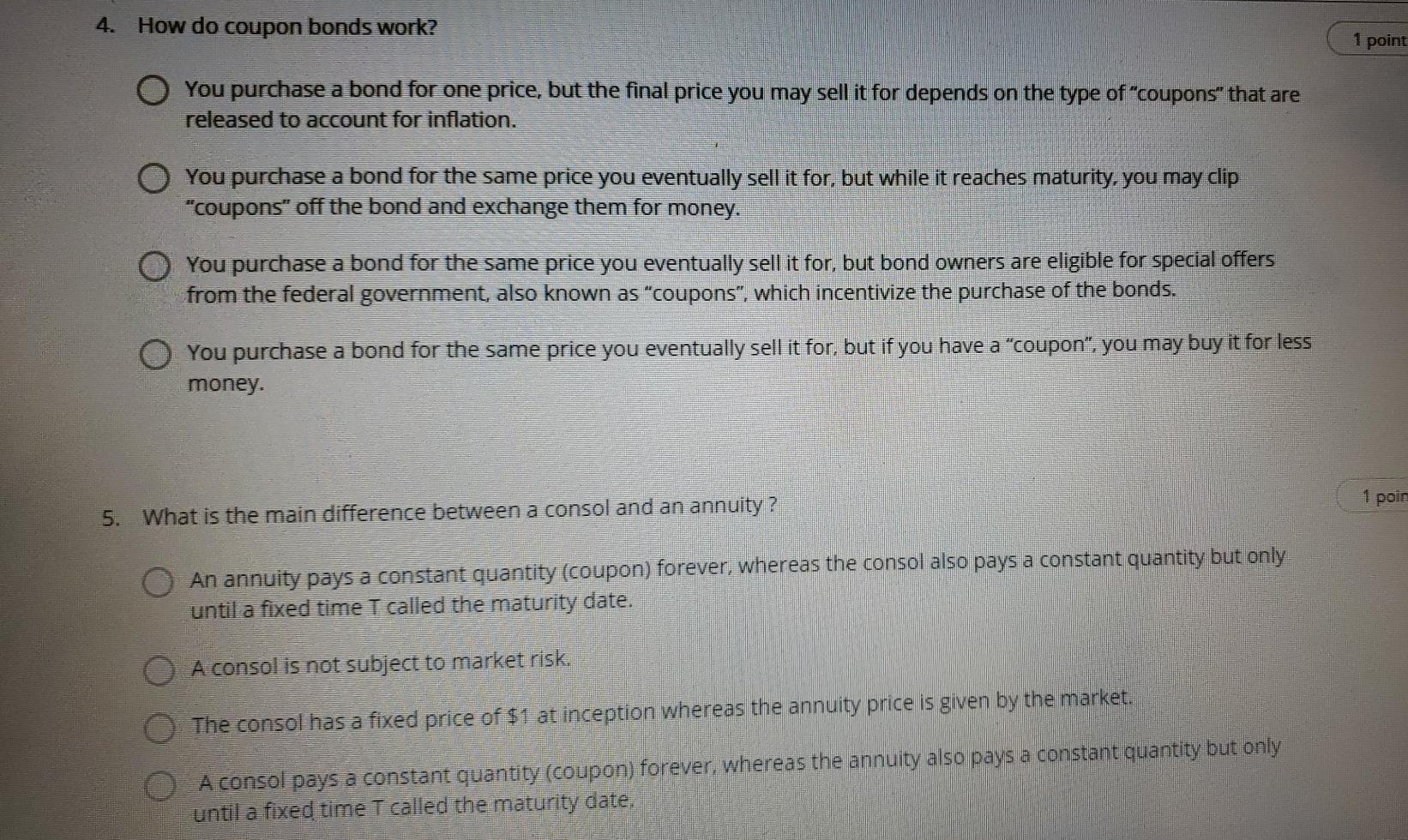

4. How do coupon bonds work? 1 point You purchase a bond for one price, but the final price you may sell it for depends on the type of "coupons" that are released to account for inflation. You purchase a bond for the same price you eventually sell it for, but while it reaches maturity, you may clip "coupons off the bond and exchange them for money. You purchase a bond for the same price you eventually sell it for, but bond owners are eligible for special offers from the federal government, also known as "coupons, which incentivize the purchase of the bonds. You purchase a bond for the same price you eventually sell it for. but if you have a "coupon", you may buy it for less money. 1 poin 5. What is the main difference between a consol and an annuity ? O An annuity pays a constant quantity (coupon) forever , whereas the consol also pays a constant quantity but only until a fixed time T called the maturity date. A consol is not subject to market risk. The consol has a fixed price of $1 at inception whereas the annuity price is given by the market. O A consol pays a constant quantity (coupon) forever, whereas the annuity also pays a constant quantity but only until a fixed time I called the maturity date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts