Question: 4. How should ACC modify its financing sales by 25 percent without operational or modifying its issuing new equity policy? c. Suppose that Aco 10

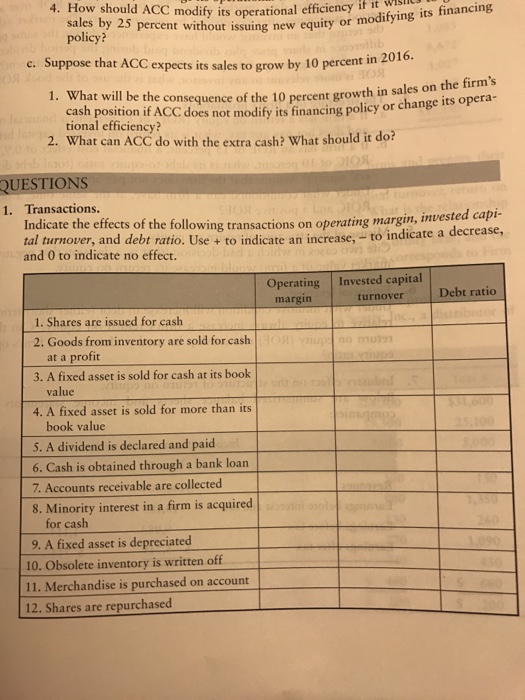

4. How should ACC modify its financing sales by 25 percent without operational or modifying its issuing new equity policy? c. Suppose that Aco 10 percent in 2016. expects its sales to grow by 1. What will be 10 growth in sales on the firm's cash position the consequence of the percent change its opera if ACC its policy or tional efficiency? 2. What can ACC do with the extra cash? What should it do? QUESTIONS 1. Transactions. invested Indicate the effects of the following transactions on operating margin, decrease. tal turnover, and debt ratio Use indicate an increase, to indicate a to and 0 to indicate no effect. Operating Invested capital Debt ratio turnover margin 1. Shares are issued for cash 2. Goods from inventory are sold for cash at a profit 3. A fixed asset is sold for cash at its book value 4. A fixed asset is sold for more than its book value 5. A dividend is declared and paid 6. Cash is obtained through a bank loan 7. Accounts receivable are collected 8. Minority interest in a firm is acquired for cash. 9. A fixed asset is depreciated 10. obsolete inventory is written off purchased on account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts