Question: 4 . Huawei has spent Y 1 . 5 B in R&D and is ready to launch the first foldable cellphone Mate X . However,

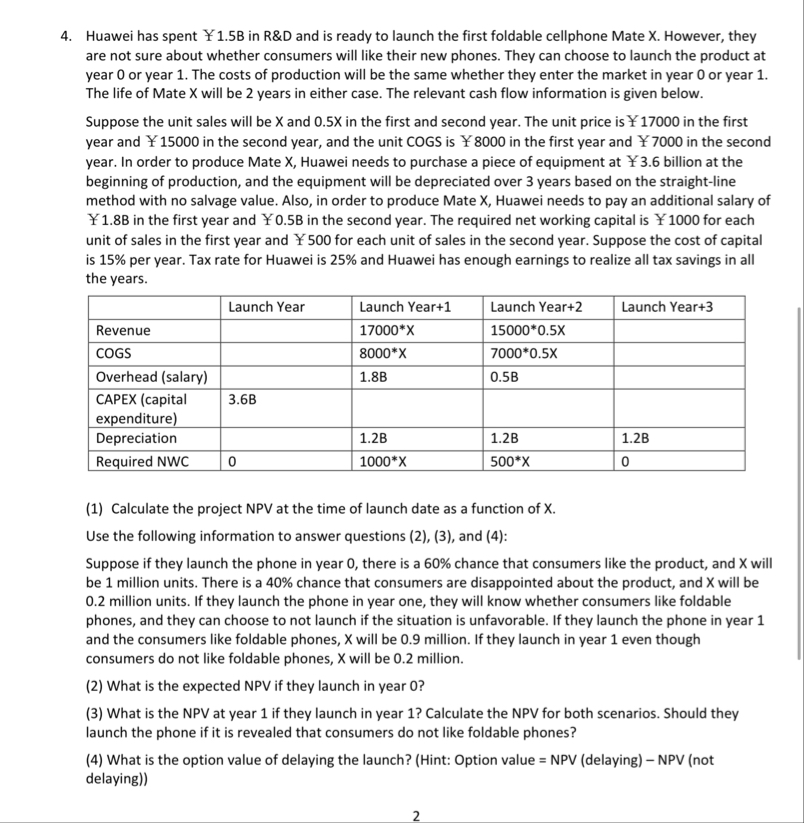

Huawei has spent Y B in R&D and is ready to launch the first foldable cellphone Mate X However, they are not sure about whether consumers will like their new phones. They can choose to launch the product at year or year The costs of production will be the same whether they enter the market in year or year The life of Mate X will be years in either case. The relevant cash flow information is given below.Suppose the unit sales will be X and X in the first and second year. The unit price is Y in the first year and Y in the second year, and the unit COGS is in the first year and Y in the second year. In order to produce Mate X Huawei needs to purchase a piece of equipment at Y billion at the beginning of production, and the equipment will be depreciated over years based on the straightline method with no salvage value. Also, in order to produce Mate X Huawei needs to pay an additional salary of I B in the first year and F B in the second year. The required net working capital is f for each unit of sales in the first year and F for each unit of sales in the second year. Suppose the cost of capital is per year. Tax rate for Huawei is and Huawei has enough earnings to realize all tax savings in all the years.Launch YearLaunch YearLaunch YearLaunch YearRevenueXXCOGSXXOverhead salaryBBCAPEX capital expenditureBDepreciationBBBRequired NWCXX Calculate the project NPV at the time of launch date as a function of XUse the following information to answer questions and :Suppose if they launch the phone in year there is a chance that consumers like the product, and X will be million units. There is a chance that consumers are disappointed about the product, and X will be million units. If they launch the phone in year one, they will know whether consumers like foldable phones, and they can choose to not launch if the situation is unfavorable. If they launch the phone in year and the consumers like foldable phones, X will be million. If they launch in year even though consumers do not like foldable phones, X will be million. What is the expected NPV if they launch in year What is the NPV at year if they launch in year Calculate the NPV for both scenarios. Should they launch the phone if it is revealed that consumers do not like foldable phones? What is the option value of delaying the launch? Hint: Option value NPV delaying NPV notdelaying

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock