Question: 4?? I need help asap! please provide full solution thanks Trek Star Productions has bonds trading in the secondary market that mature in 15.00 years.

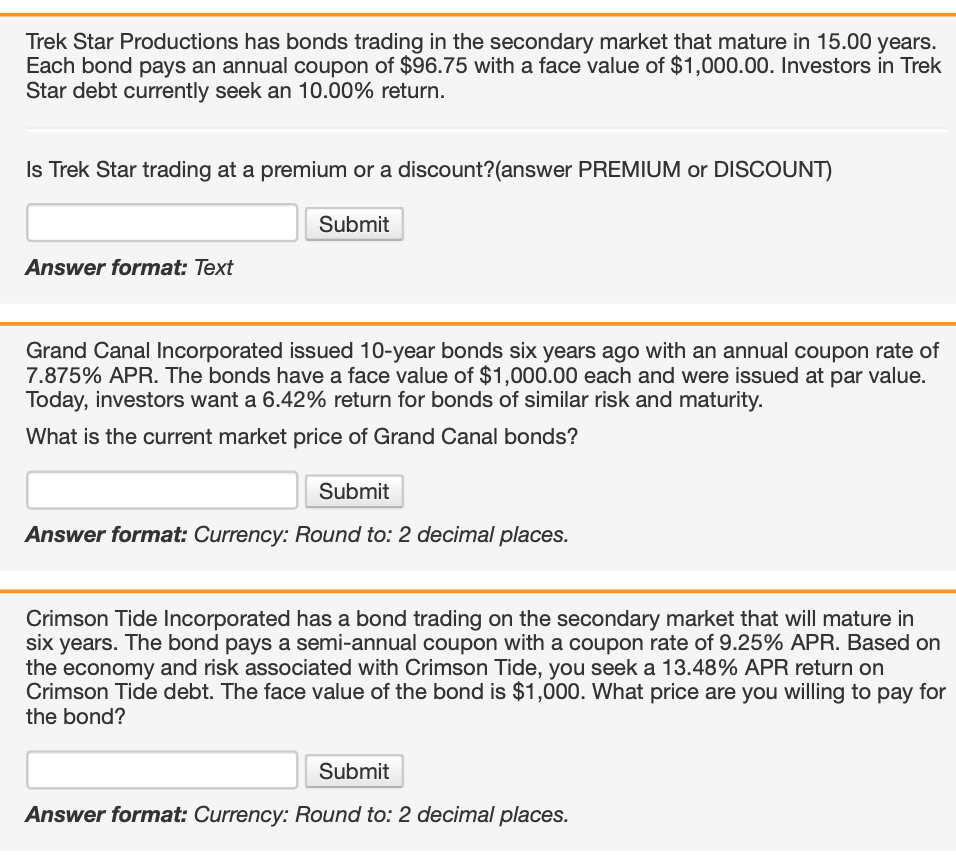

4?? I need help asap! please provide full solution thanks  Trek Star Productions has bonds trading in the secondary market that mature in 15.00 years. Each bond pays an annual coupon of $96.75 with a face value of $1,000.00. Investors in Trek Star debt currently seek an 10.00% return. Is Trek Star trading at a premium or a discount?(answer PREMIUM or DISCOUNT) Answer format: Text Grand Canal Incorporated issued 10-year bonds six years ago with an annual coupon rate of 7.875% APR. The bonds have a face value of $1,000.00 each and were issued at par value. Today, investors want a 6.42% return for bonds of similar risk and maturity. What is the current market price of Grand Canal bonds? Answer format: Currency: Round to: 2 decimal places. Crimson Tide Incorporated has a bond trading on the secondary market that will mature in six years. The bond pays a semi-annual coupon with a coupon rate of 9.25\% APR. Based on the economy and risk associated with Crimson Tide, you seek a 13.48\% APR return on Crimson Tide debt. The face value of the bond is $1,000. What price are you willing to pay for the bond? Answer format: Currency: Round to: 2 decimal places

Trek Star Productions has bonds trading in the secondary market that mature in 15.00 years. Each bond pays an annual coupon of $96.75 with a face value of $1,000.00. Investors in Trek Star debt currently seek an 10.00% return. Is Trek Star trading at a premium or a discount?(answer PREMIUM or DISCOUNT) Answer format: Text Grand Canal Incorporated issued 10-year bonds six years ago with an annual coupon rate of 7.875% APR. The bonds have a face value of $1,000.00 each and were issued at par value. Today, investors want a 6.42% return for bonds of similar risk and maturity. What is the current market price of Grand Canal bonds? Answer format: Currency: Round to: 2 decimal places. Crimson Tide Incorporated has a bond trading on the secondary market that will mature in six years. The bond pays a semi-annual coupon with a coupon rate of 9.25\% APR. Based on the economy and risk associated with Crimson Tide, you seek a 13.48\% APR return on Crimson Tide debt. The face value of the bond is $1,000. What price are you willing to pay for the bond? Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts