Question: 4. In the Excel template, navigate to the Requirement 4 tab. Using Solver: a. Calculate the maximum contribution margin the company can earn given the

4. In the Excel template, navigate to the Requirement 4 tab. Using Solver: a. Calculate the maximum contribution margin the company can earn given the capacities of its four manufacturing departments. b. How many units of each product would the company produce to earn the contribution margin from requirement 4a?

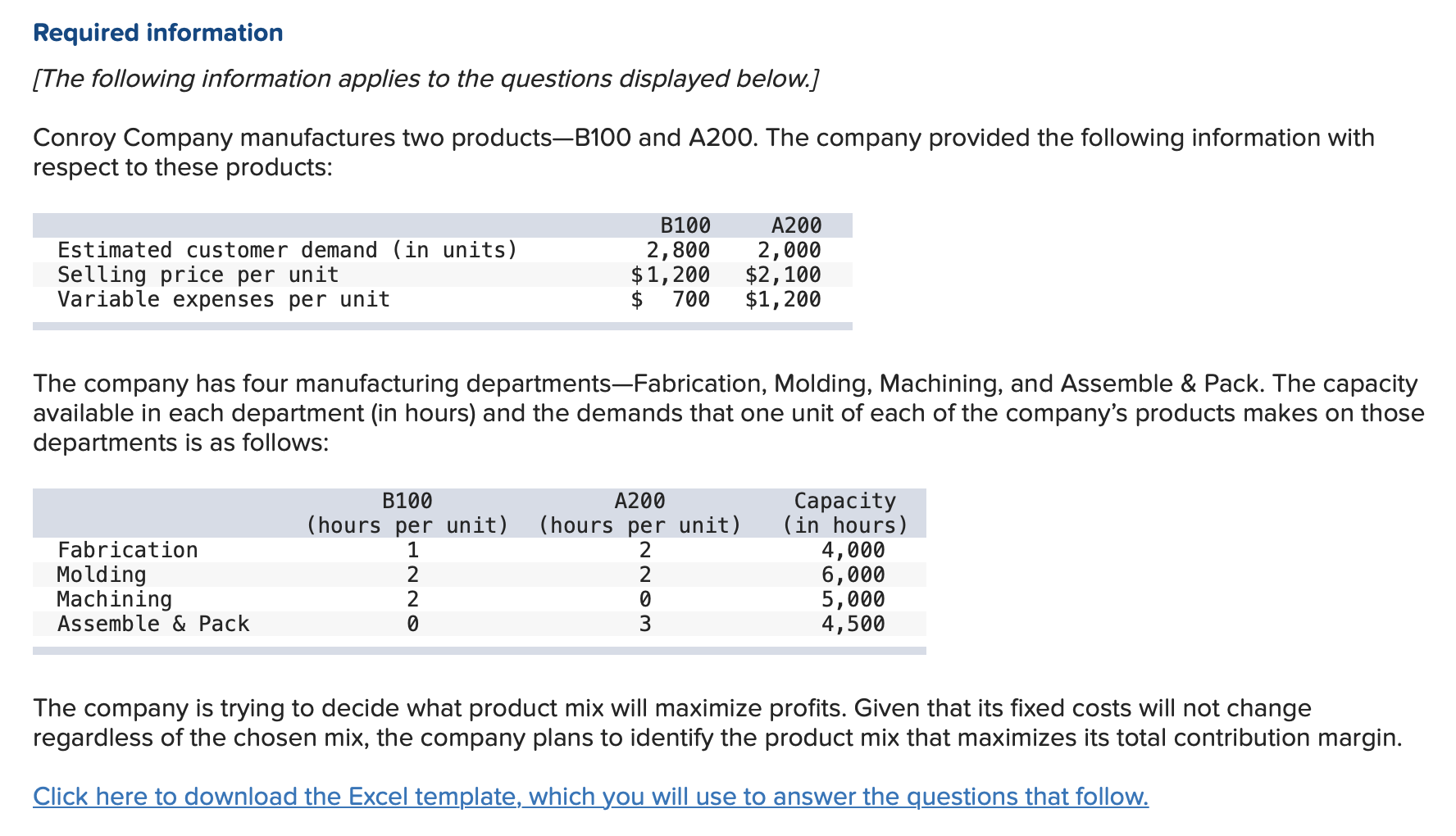

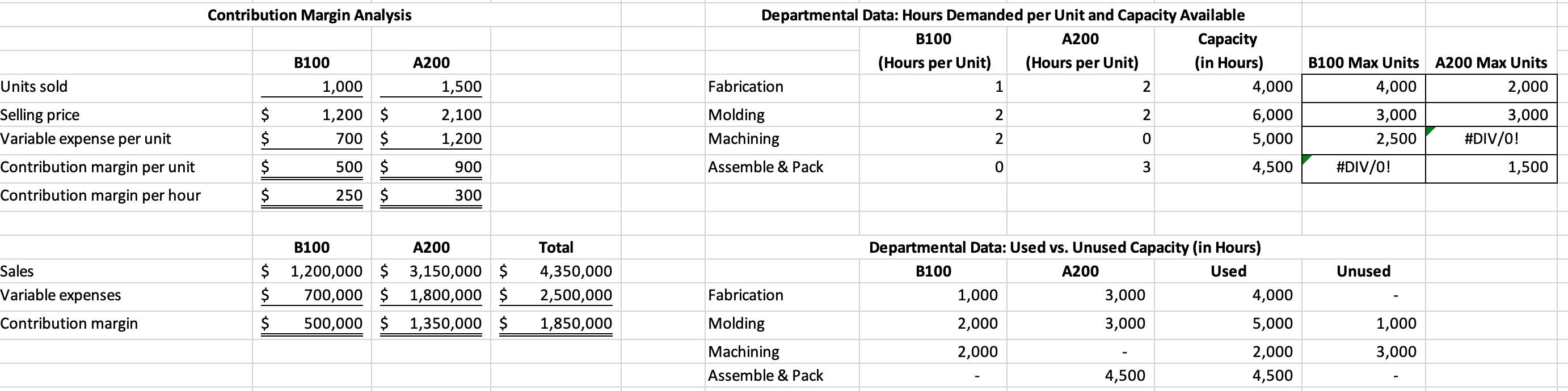

Required information [The following information applies to the questions displayed below.] Conroy Company manufactures two productsB100 and A200. The company provided the following information with respect to these products: Estimated customer demand (in units) Selling price per unit Variable expenses per unit B100 2,800 $1,200 $ 700 A200 2,000 $2,100 $1,200 The company has four manufacturing departmentsFabrication, Molding, Machining, and Assemble & Pack. The capacity available in each department (in hours) and the demands that one unit of each of the company's products makes on those departments is as follows: B100 (hours per unit) A200 (hours per unit) Fabrication Molding Machining Assemble & Pack WONN Capacity (in hours) 4,000 6,000 5,000 4,500 ON The company is trying to decide what product mix will maximize profits. Given that its fixed costs will not change regardless of the chosen mix, the company plans to identify the product mix that maximizes its total contribution margin. Click here to download the Excel template, which you will use to answer the questions that follow. Contribution Margin Analysis B100 Max Units A200 Max Units Units sold Selling price Variable expense per unit Contribution margin per unit Contribution margin per hour 4,000 B100 1,000 1,200 $ 700 $ 500 $ 250 $ Departmental Data: Hours Demanded per Unit and Capacity Available B100 A200 Capacity (Hours per Unit) (Hours per Unit) (in Hours) Fabrication 4,000 Molding 6,000 Machining 5,000 Assemble & Pack 4,500 A200 1,500 2,100 1,200 900 300 w o NN 3,000 2,500 #DIV/0! 2,000 3,000 #DIV/0! 1,500 Unused Sales Variable expenses Contribution margin $ $ $ B100 1,200,000 $ 700,000 $ 500,000 $ A200 3,150,000 $ 1,800,000 $ 1,350,000 $ Total 4,350,000 2,500,000 1,850,000 Departmental Data: Used vs. Unused Capacity (in Hours) B100 A200 Used 1,000 3,000 4,000 2,000 3,000 5,000 2,000 2,000 4,500 4,500 Fabrication Molding Machining Assemble & Pack 1,000 3,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts