Question: 4. In the setting of problem 3(a), John will transfer her money at the age of 65 (his retirement) from his 401K account (valued at

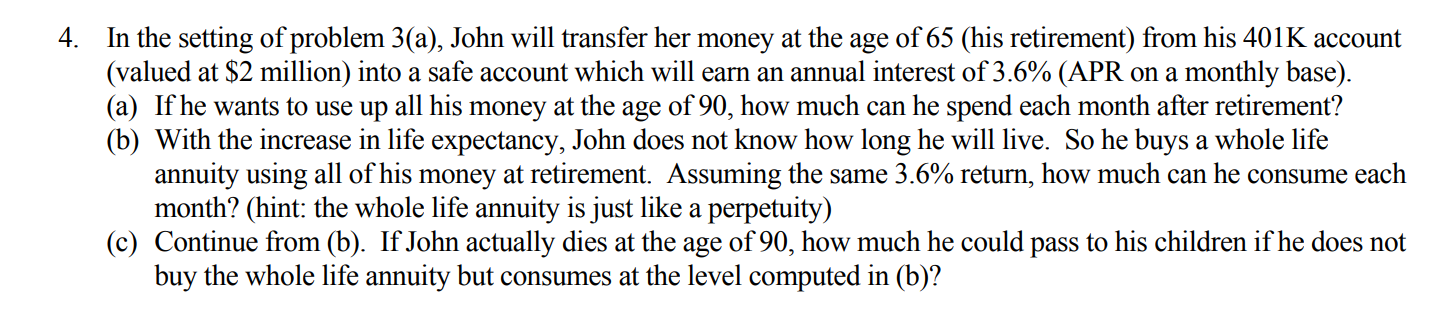

4. In the setting of problem 3(a), John will transfer her money at the age of 65 (his retirement) from his 401K account (valued at $2 million) into a safe account which will earn an annual interest of 3.6% (APR on a monthly base). (a) If he wants to use up all his money at the age of 90, how much can he spend each month after retirement? (b) With the increase in life expectancy, John does not know how long he will live. So he buys a whole life annuity using all of his money at retirement. Assuming the same 3.6% return, how much can he consume each month? (hint: the whole life annuity is just like a perpetuity) (c) Continue from (b). If John actually dies at the age of 90, how much he could pass to his children if he does not buy the whole life annuity but consumes at the level computed in (b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts