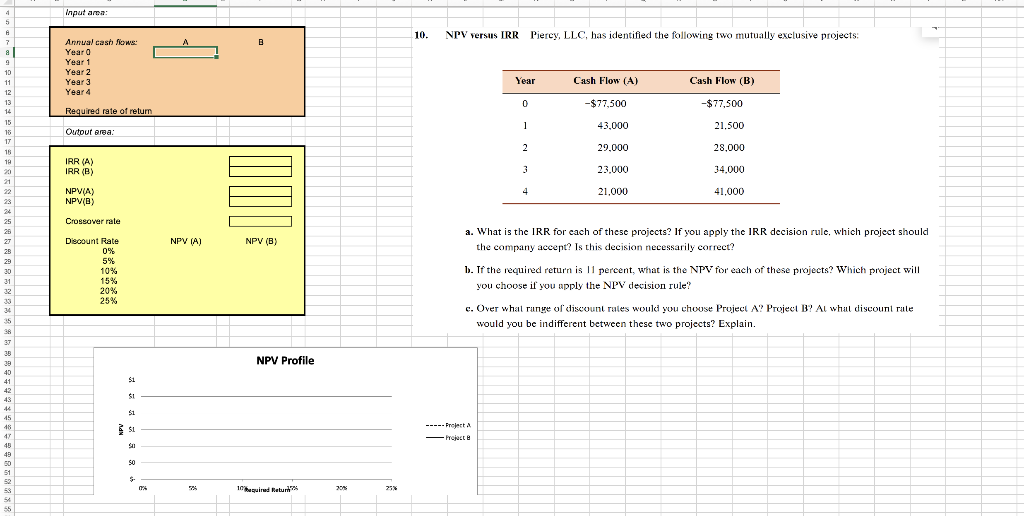

Question: 4 Input ama: 5 10. NPV versus IRR Piercy, LLC, has identified the following two mutually exclusive projects. 7 B Annual cash flows: Year 0

4 Input ama: 5 10. NPV versus IRR Piercy, LLC, has identified the following two mutually exclusive projects. 7 B Annual cash flows: Year 0 Year 1 Year 2 Year 3 Year 4 A Year Cash Flow (A) Cash Flow (B) (B -$77,500 0 -$77,500 Required rate of retum 1 Outour area: 43,000 21,500 2 29,000 28,000 IRR (A) IRR (B) 3 23.000 34.000 9 10 11 12 13 14 15 18 17 18 19 20 21 22 ** 23 24 25 26 27 25 29 30 31 22 33 4 21.000 41.000 NPVIA) NPV(B) 1001: Crossover rate NPV (A) NPV (B) Discount Rate 0% 5% 10% 15% 20% 25% a. What is the IRR for each of these projects? If you apply the IRR decision rule, which project should the company accept? Is this decision necessarily correct? 1). If the required return is 11 percent, what is the NPV for each of these projects? Which project will you choose if you apply the NPV decision rule? c. Over whal runye of discount rates would you choose Project A? Project B? Al whal discount rule would you be indifferent between these two projects? Explain. 35 NPV Profile Si SI S1 38 37 36 39 40 41 42 43 42 45 48 47 45 49 50 51 52 53 5 55 $ ---- -Project 50 TA 10guired Return 2013 25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts