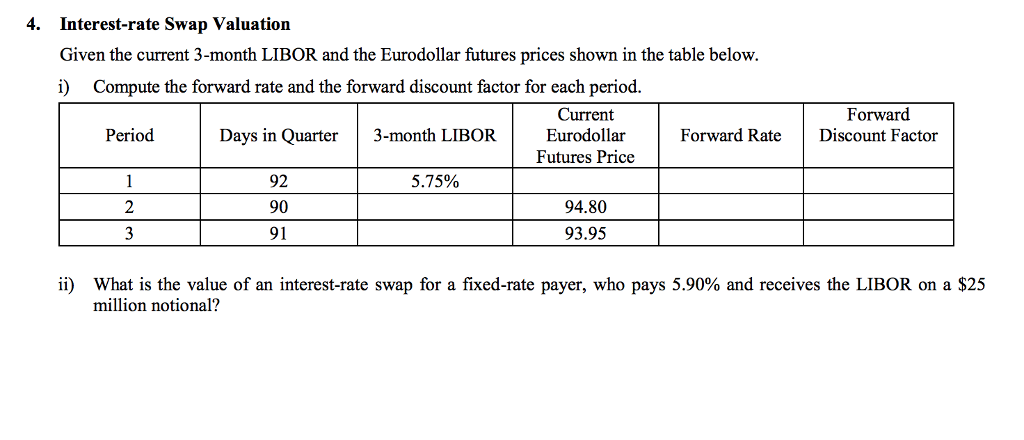

Question: 4. Interest-rate Swap Valuation Given the current 3-month LIBOR and the Eurodollar futures prices shown in the table below. i) Compute the forward rate and

4. Interest-rate Swap Valuation Given the current 3-month LIBOR and the Eurodollar futures prices shown in the table below. i) Compute the forward rate and the forward discount factor for each period. Current Forward Period Days in Quarter 3-month LIBOR EurodollarForward RateDiscount Factor Futures Price 92 90 91 5.75% 94.80 93.95 what is the value of an interest-rate swap for a fixed-rate payer, who pays 5.90% and receives the LIBOR on a $25 million notional? ii)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock