Question: 4. Itemized deductions reported on Schedule A may include all of the following except: a. Interest paid on the mortgage for their vacation home. b.

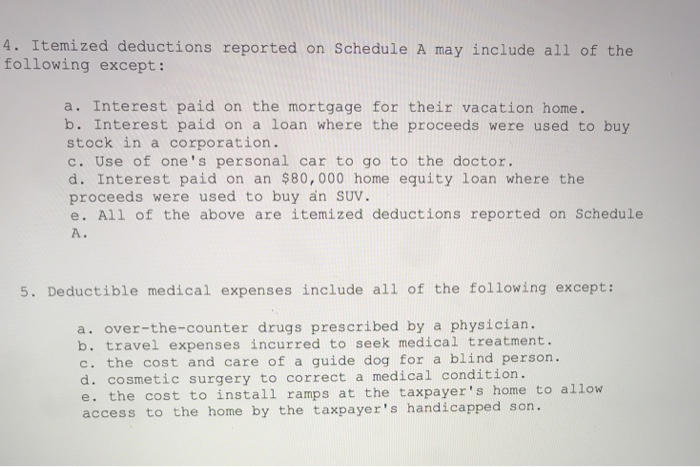

4. Itemized deductions reported on Schedule A may include all of the following except: a. Interest paid on the mortgage for their vacation home. b. Interest paid on a loan where the proceeds were used to buy stock in a corporation. c. Use of one's personal car to go to the doctor. d. Interest paid on an $80,000 home equity loan where the proceeds were used to buy an SUV. e. All of the above are itemized deductions reported on Schedule A. 5. Deductible medical expenses include all of the following except: a. over-the-counter drugs prescribed by a physician. b. travel expenses incurred to seek medical treatment. c. the cost and care of a guide dog for a blind person. d. cosmetic surgery to correct a medical condition. e. the cost to install ramps at the taxpayer's home to allow access to the home by the taxpayer's handicapped son

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts