Question: 4. Jefferson Products Inc. is considering purchasing a new automatic press brake, which costs $300,000 including installation and shipping. The machine is expected to generate

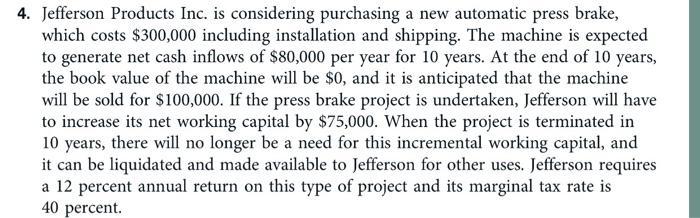

4. Jefferson Products Inc. is considering purchasing a new automatic press brake, which costs $300,000 including installation and shipping. The machine is expected to generate net cash inflows of $80,000 per year for 10 years. At the end of 10 years, the book value of the machine will be $0, and it is anticipated that the machine will be sold for $100,000. If the press brake project is undertaken, Jefferson will have to increase its net working capital by $75,000. When the project is terminated in 10 years, there will no longer be a need for this incremental working capital, and it can be liquidated and made available to Jefferson for other uses. Jefferson requires a 12 percent annual return on this type of project and its marginal tax rate is 40 percent. What is the Period 10 cash flow including terminal valuations? Do not use a dollar sign or a comma in your answer. A/ Question 4 (5 points) What is the IRR of the project? Use a percent sign and round your answer to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts