Question: 4. (Lecture Note 2) Consider a 9-month forward contract on Amazon.com Inc. (AMZN). The current price of one share is $1,670, and the annual continuously

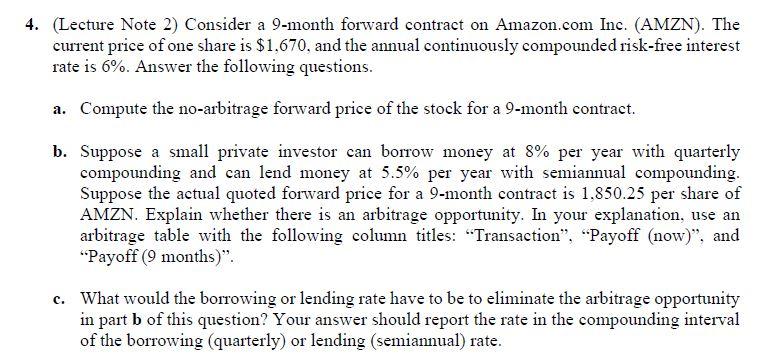

4. (Lecture Note 2) Consider a 9-month forward contract on Amazon.com Inc. (AMZN). The current price of one share is $1,670, and the annual continuously compounded risk-free interest rate is 6%. Answer the following questions. a. Compute the no-arbitrage forward price of the stock for a 9-month contract. b. Suppose a small private investor can borrow money at 8% per year with quarterly compounding and can lend money at 5.5% per year with semiannual compounding. Suppose the actual quoted forward price for a 9-month contract is 1,850.25 per share of AMZN. Explain whether there is an arbitrage opportunity. In your explanation, use an arbitrage table with the following column titles: "Transaction", "Payoff (now)", and "Payoff (9 months)". c. What would the borrowing or lending rate have to be to eliminate the arbitrage opportunity in part b of this question? Your answer should report the rate in the compounding interval of the borrowing (quarterly) or lending (semiannual) rate. 4. (Lecture Note 2) Consider a 9-month forward contract on Amazon.com Inc. (AMZN). The current price of one share is $1,670, and the annual continuously compounded risk-free interest rate is 6%. Answer the following questions. a. Compute the no-arbitrage forward price of the stock for a 9-month contract. b. Suppose a small private investor can borrow money at 8% per year with quarterly compounding and can lend money at 5.5% per year with semiannual compounding. Suppose the actual quoted forward price for a 9-month contract is 1,850.25 per share of AMZN. Explain whether there is an arbitrage opportunity. In your explanation, use an arbitrage table with the following column titles: "Transaction", "Payoff (now)", and "Payoff (9 months)". c. What would the borrowing or lending rate have to be to eliminate the arbitrage opportunity in part b of this question? Your answer should report the rate in the compounding interval of the borrowing (quarterly) or lending (semiannual) rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts