Question: 4 marks) QUESTION TWO (10 MARKS) (a) Explain four functions of international derivatives market. (b)Brigg Plc a UK firm exports its products throughout the world.

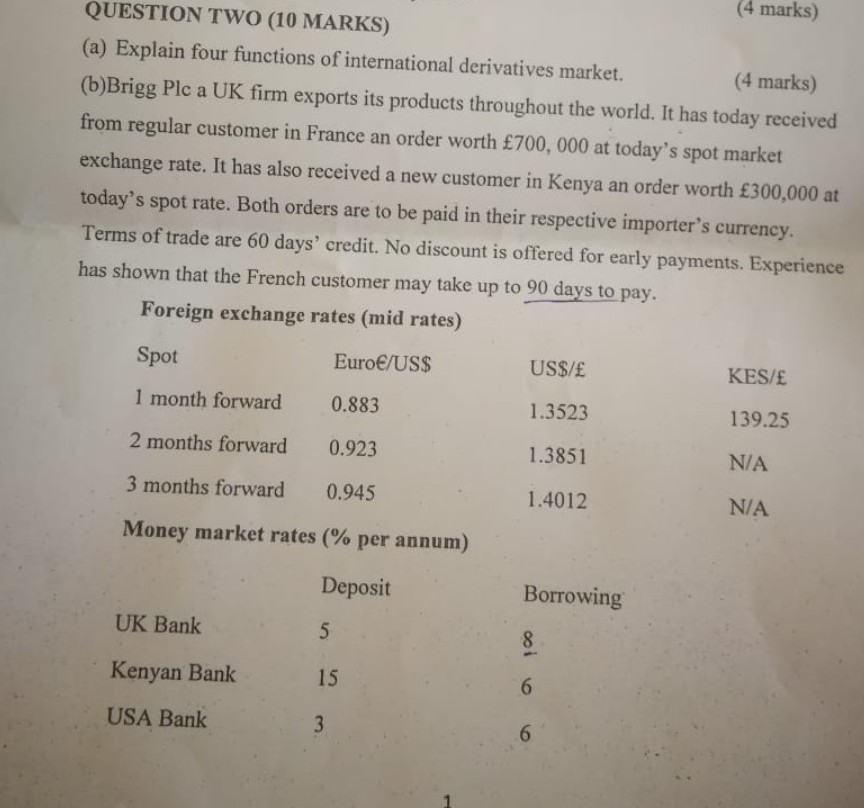

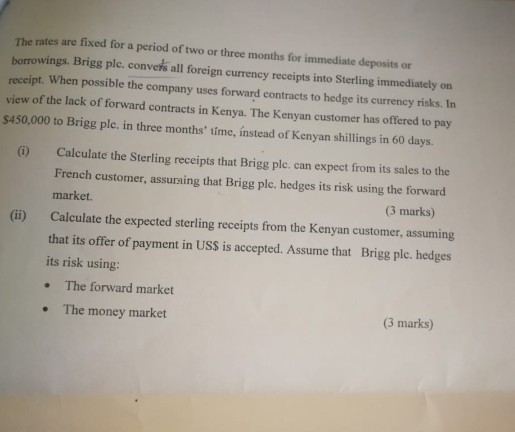

4 marks) QUESTION TWO (10 MARKS) (a) Explain four functions of international derivatives market. (b)Brigg Plc a UK firm exports its products throughout the world. It has today received from regular customer in France an order worth 700, 000 at today's spot market exchange rate. It has also received a new customer in Kenya an order worth 300,000 at today's spot rate. Both orders are to be paid in their respective importer's currency. Terms of trade are 60 days' credit. No discount is offered for early payments. Experience has shown that the French customer may take up to 90 days to pay (4 marks) Foreign exchange rates (mid rates) Spot 1 month forward 0.883 2 months forward 0.923 3 months forward 0.945 Money market rates (% per annum) KES/E 139.25 N/A N/A Euroe/USS USS/E 1.3523 1.3851 1.4012 Deposit Borrowing UK Bank Kenyan Bank USA Bank 15 The rates are fixed borrowings. Brigg ple. convers all foreign currency receipts into Sterling immediately on receipt. When possible the company uses forward contracts to hedge its currency risks. In view of the lack of forward contracts in Kenya. The Kenyan customer has offered to pay $450,000 to Brigg ple. in three months' time, instead of Kenyan shillings in 60 days. for a period of two or three months for immediate deposits or ) Calculate the Sterling receipts that Brigg ple. can expect from its sales to the French customer, assuraing that Brigg ple. hedges its risk using the forward market Calculate the expected sterling receipts from the Kenyan customer, assuming that its offer of payment in USS is accepted. Assume that its risk using: . The forward market . The money market (3 marks) (ii) Brigg ple. hedges

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts