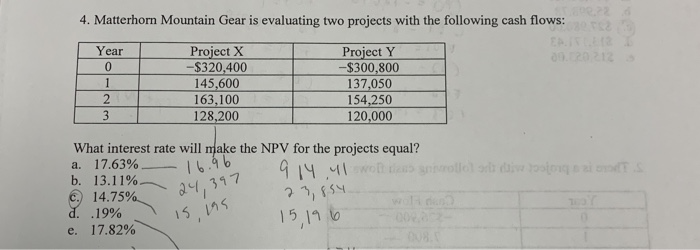

Question: 4. Matterhorn Mountain Gear is evaluating two projects with the following cash flows: Year 0 Project X -$320,400 145,600 163,100 128,200 Project Y -$300,800 137,050

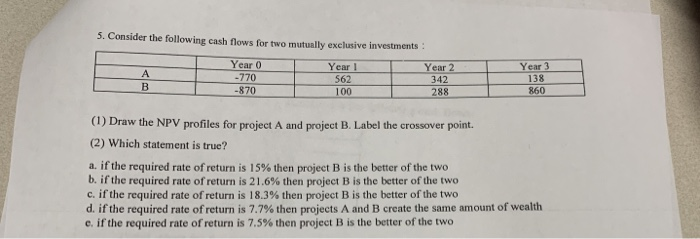

4. Matterhorn Mountain Gear is evaluating two projects with the following cash flows: Year 0 Project X -$320,400 145,600 163,100 128,200 Project Y -$300,800 137,050 154,250 120,000 2 3 d TS What interest rate will make the NPV for the projects equal? a. 17.63% 16.95 b. 13.11% 914 wollte shtro 347 23,854 d. .19% 15 195 15,19 6 e. 17.82% C. 14.75% 24,37 5. Consider the following cash flows for two mutually exclusive investments Year 0 Year! Year 2 A -770 S62 342 B -870 100 2 88 Year 3 138 860 L 1 (1) Draw the NPV profiles for project A and project B. Label the crossover point. (2) Which statement is true? a. if the required rate of return is 15% then project B is the better of the two b. if the required rate of return is 21.6% then project B is the better of the two c. if the required rate of return is 18.3% then project B is the better of the two d. if the required rate of return is 7.7% then projects A and B create the same amount of wealth e. if the required rate of return is 7.5% then project B is the better of the two

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts