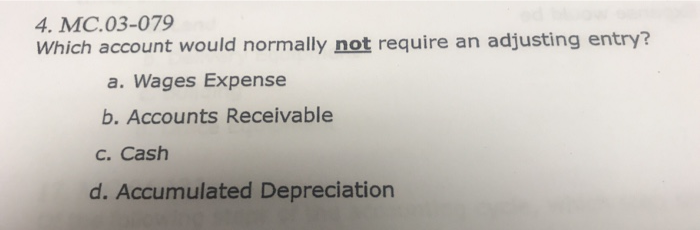

Question: 4. MC.03-079 Which account would normally not require an adjusting entry? a. Wages Expense b. Accounts Receivable C. Cash d. Accumulated Depreciation 6. MC.03-081 The

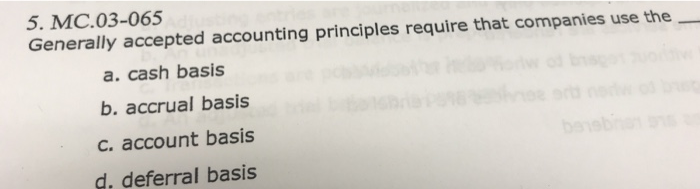

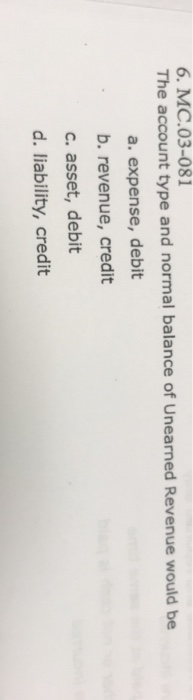

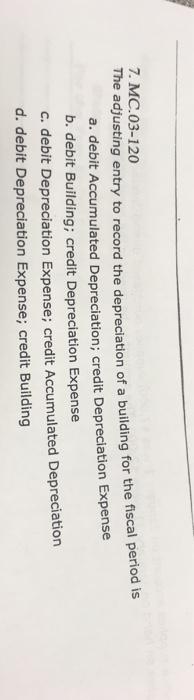

4. MC.03-079 Which account would normally not require an adjusting entry? a. Wages Expense b. Accounts Receivable C. Cash d. Accumulated Depreciation 6. MC.03-081 The account type and normal balance of Unearned Revenue would be a. expense, debit b. revenue, credit c. asset, debit d. liability, credit 7. MC.03-120 The adjusting entry to record the depreciation of a building for the fiscal period is a. debit Accumulated Depreciation; credit Depreciation Expense b. debit Building; credit Depreciation Expense C. debit Depreciation Expense; credit Accumulated Depreciation d. debit Depreciation Expense; credit Building d. debit Depreciation Expense; credit Building asset account and the related accumulated depreciation account is 8. MC.03-119 The difference between the balance of a fixed asset account and the termed a. market value b. historical cost c. book value d. contra asset 3. contra asset 0. If $18,000 of the $72,000 is unearned at the end 9. MC.03-108 The unearned rent account has a balance of $72,000. If $18,000 of the $72.000 accounting period, the amount of the adjusting entry is a. $90,000 b. $54,000 C. $18,000 d. $36,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts