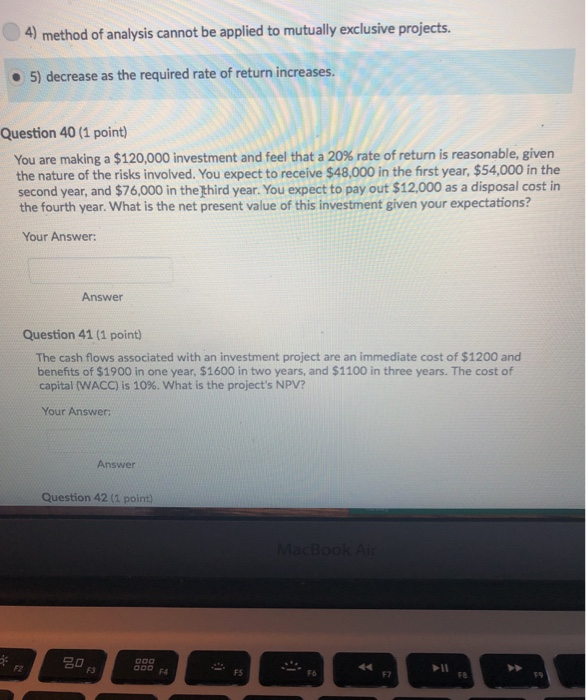

Question: 4) method of analysis cannot be applied to mutually exclusive projects -5) decrease as the required rate of return increases. Question 40 (1 point) You

4) method of analysis cannot be applied to mutually exclusive projects -5) decrease as the required rate of return increases. Question 40 (1 point) You are making a $120,000 investment and feel that a 20% rate of return is reasonable, given the nature of the risks involved. You expect to receive $48,000 in the first year, $54,000 in the second year, and $76,000 in the third year. You expect to pay out $12.000 as a disposal cost in the fourth year. What is the net present value of this investment given your expectations? Your Answer: Answer Question 41 (1 point) The cash flows associated with an investment project are an immediate cost of $1200 and benefits of $1900 in one year, $1600 in two years, and $1100 in three years. The cost of capital (WACC) is 10%, what is the project's NPV? Your Answer: Answer Question 42 (1 point) F2 F3 FS F7 FS F9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts