Question: 4. More on the IPO process The IPO process involves several entities, such as the issuing company, institutional investors, brokers, lawyers, regulators, retail investors, and

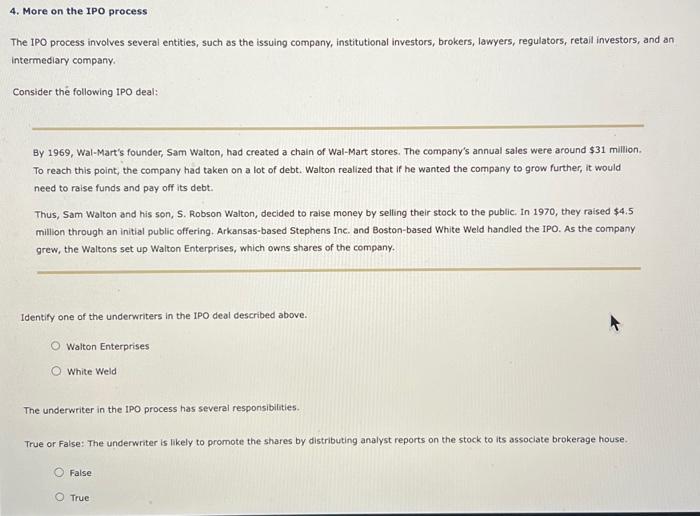

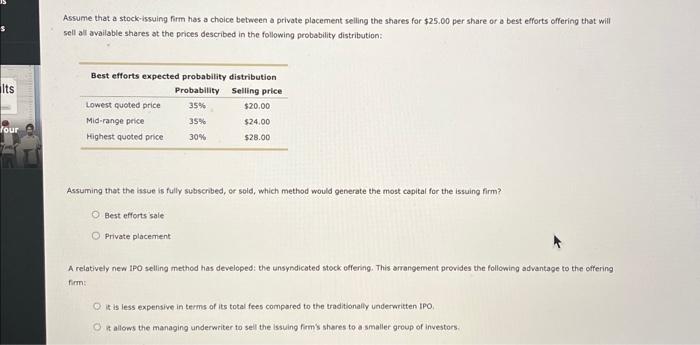

4. More on the IPO process The IPO process involves several entities, such as the issuing company, institutional investors, brokers, lawyers, regulators, retail investors, and an intermediary company. Consider the following IPO deal: By 1969, Wal-Mart's founder, Sam Walton, had created a chain of Wal-Mart stores. The company's annual sales were around $31 million. To reach this point, the company had taken on a lot of debt. Walton realized that if he wanted the company to grow further, it would need to raise funds and pay off its debt. Thus, Sam Walton and his son, S. Robson Waiton, decided to raise money by selling their stock to the public. In 1970 , they raised $4.5 million through an initial public offering. Arkansas-based Stephens Inc. and Boston-based White Weld handled the IPO. As the company grew, the Waltons set up Walton Enterprises, which owns shares of the company. Identify one of the underwriters in the IPO deal described above. Walton Enterprises White Weld The underwriter in the IPO process has several responsibilities. True or False: The underwriter is likely to promote the shares by distributing analyst reports on the stock to its associate brokerage house. False True Assume that a stock-issuing firm has a choice between a private placement selling the shares for $25.00 per share or a best efforts offering that will sell all available shares at the prices described in the following probability distribution: Assuming that the issue is fully subscribed, or sold, which method would generate the most capital for the issuing firm? Best efforts sale Private placement A relatively new IPO selling method has developed: the unsyndicated stock olfening. This arrangement provides the following advantage to the offering firm: Li is less expensive in terms of its total fees compsred to the traditionally underwritten IPO, It allows the managing underwriter to sell the issuing firm's shares to a smaller group of investors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts