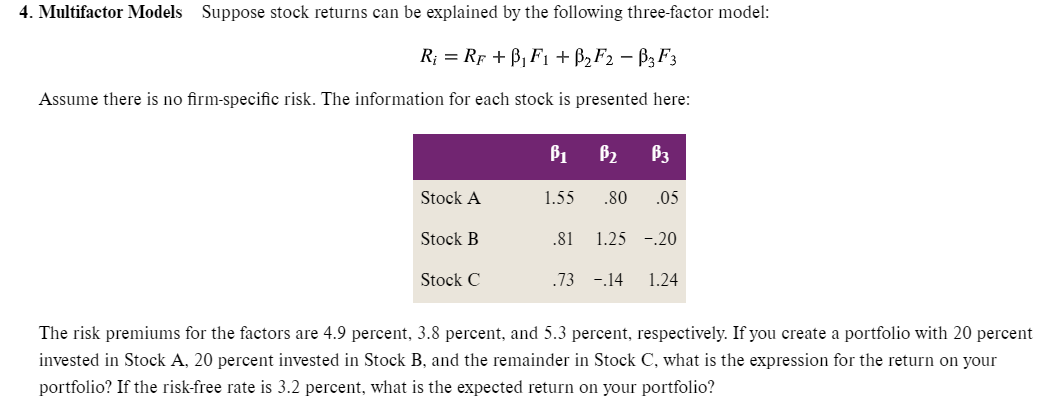

Question: 4. Multifactor Models Suppose stock returns can be explained by the following three-factor model: R; = RF + B, F1 + B2 F2 - B3F3

4. Multifactor Models Suppose stock returns can be explained by the following three-factor model: R; = RF + B, F1 + B2 F2 - B3F3 Assume there is no firm-specific risk. The information for each stock is presented here: B1 B2 B3 Stock A 1.55 .80 .05 Stock B .81 1.25 -.20 Stock C .73 -.14 1.24 The risk premiums for the factors are 4.9 percent, 3.8 percent, and 5.3 percent, respectively. If you create a portfolio with 20 percent invested in Stock A, 20 percent invested in Stock B, and the remainder in Stock C, what is the expression for the return on your portfolio? If the risk-free rate is 3.2 percent, what is the expected return on your portfolio

Step by Step Solution

There are 3 Steps involved in it

To solve this well first find the portfolios overall beta coefficients for each factor Then well cal... View full answer

Get step-by-step solutions from verified subject matter experts