Question: 4 multiple choice questions. (As per chegg study policy.) thanks A company acquired an office building on three acres of land for a lump sum

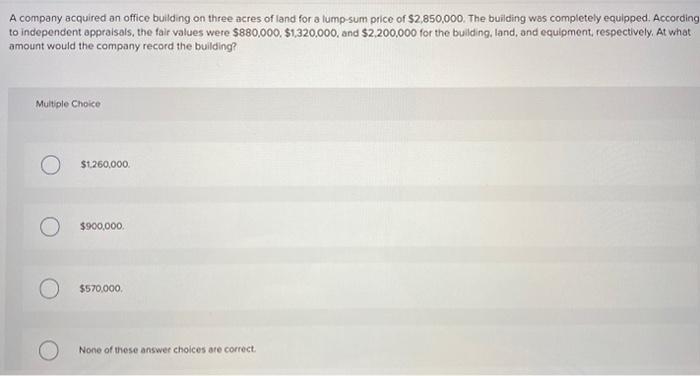

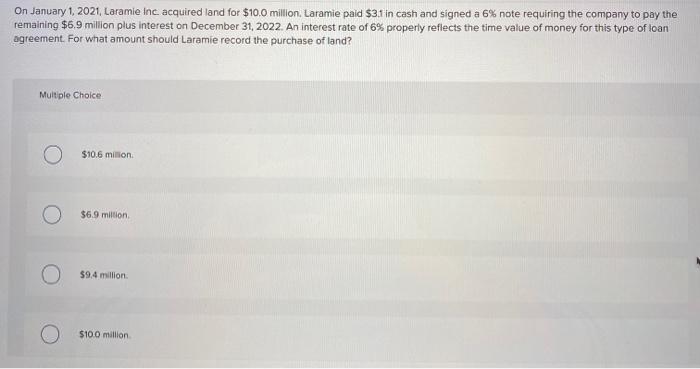

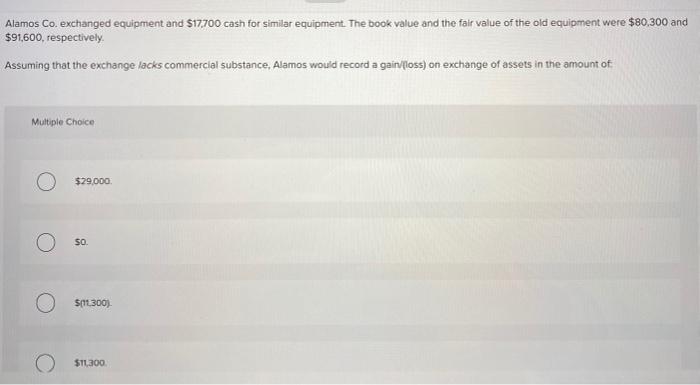

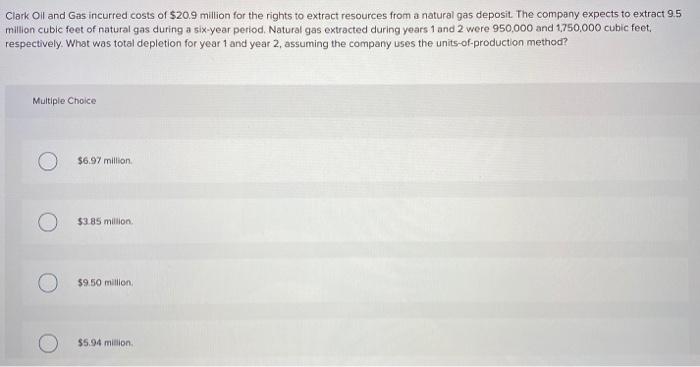

A company acquired an office building on three acres of land for a lump sum price of $2,850,000. The building was completely equipped. According to independent appraisals, the fair values were $880,000 $1,320,000, and $2,200,000 for the building, land, and equipment, respectively. At what amount would the company record the building? Multiple Choice St.260,000 $900.000 $570,000 None of these answer choices are correct On January 1, 2021, Laramie Inc. acquired land for $10.0 million, Laramie paid $3.1 in cash and signed a 6% note requiring the company to pay the remaining $6.9 million plus interest on December 31, 2022. An interest rate of 6% properly reflects the time value of money for this type of loan agreement . For what amount should Laramie record the purchase of land? Multiple Choice $10.6 million $6.9 million $9.4 million $10.0 million Alamos Co. exchanged equipment and $17,700 cash for similar equipment. The book value and the fair value of the old equipment were $80,300 and $91,600, respectively Assuming that the exchange lacks commercial substance, Alamos would record a gainoss) on exchange of assets in the amount of Multiple Choice $29.000 SO S112300) $11.300 Clark Oil and Gas incurred costs of $20.9 million for the rights to extract resources from a natural gas deposit. The company expects to extract 9.5 million cubic feet of natural gas during a six-year period. Natural gas extracted during years 1 and 2 were 950,000 and 1,750,000 cubic feet, respectively. What was total depletion for year 1 and year 2, assuming the company uses the units-of-production method? Multiple Choice $6.97 million $385 million $9.50 million $5.94 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts