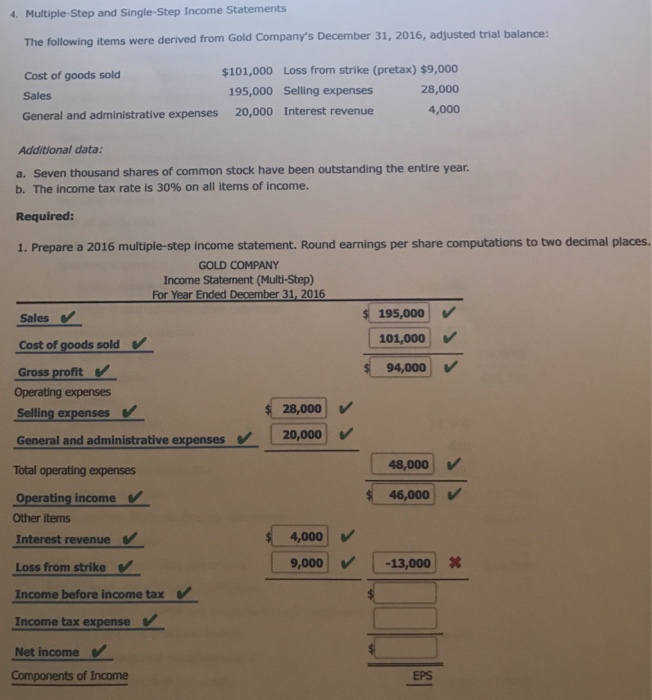

Question: 4. Multiple step and single-step Income Statements The items were derived from Gold Company's December 31, 2016, adjusted trial balance: following $101,000 Loss from strike

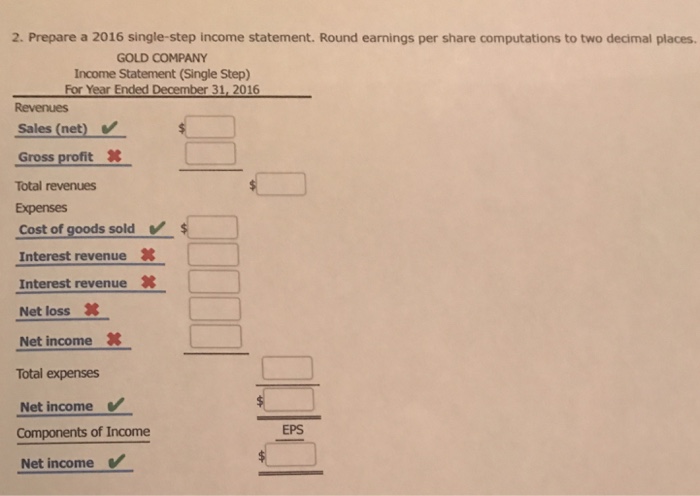

4. Multiple step and single-step Income Statements The items were derived from Gold Company's December 31, 2016, adjusted trial balance: following $101,000 Loss from strike (pretax) $9,000 Cost of goods sold 28,000 195,000 Selling expenses Sales 4,000 General and administrative expenses 20,000 Interest revenue Additional data: a. Seven thousand shares of common stock have been outstanding the entire year. b. The income tax rate is 30% on all items of income. Required: 1. Prepare a 2016 multiple-step income statement. Round earnings per share computations to two decimal places. GOLD COMPANY Income Statement (Multi-Step) For Year Ended December 31 2016 195,000 Sales 101,000 Cost of goods sold 94,000 Gross profit operating expenses s 28,000 Selling expenses General and administrative expenses 20,000 48,000 Total operating expenses 46,000 operating income Other items 4,000 Interest revenue 9,000 -13,000 Loss from strike Income before income tax Income tax expense Net income Components of Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts