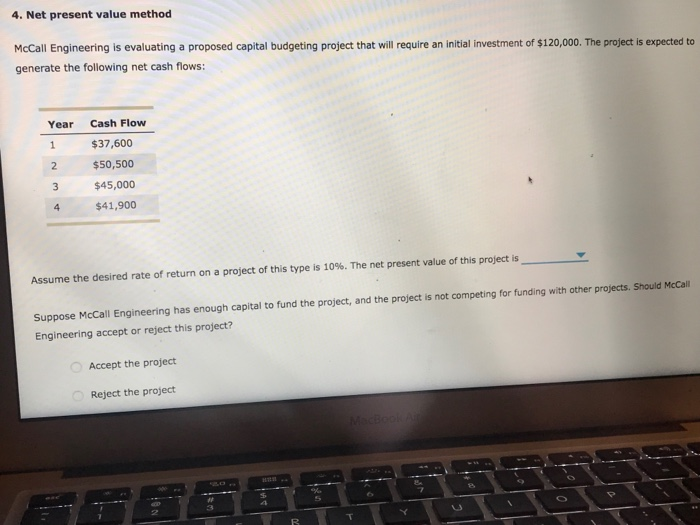

Question: 4. Net present value method McCall Engineering is evaluating a proposed capital budgeting project that will require an initial investment of $120,000. The project is

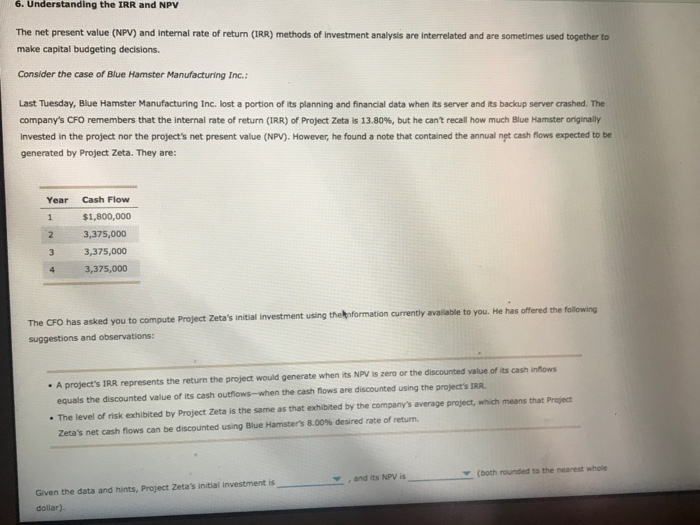

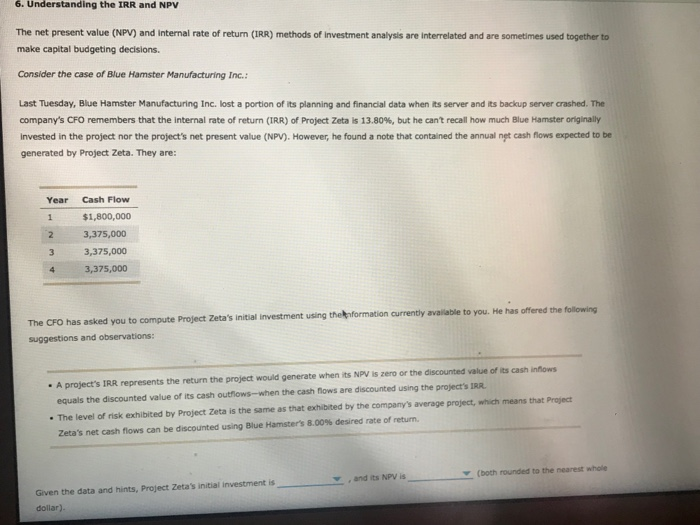

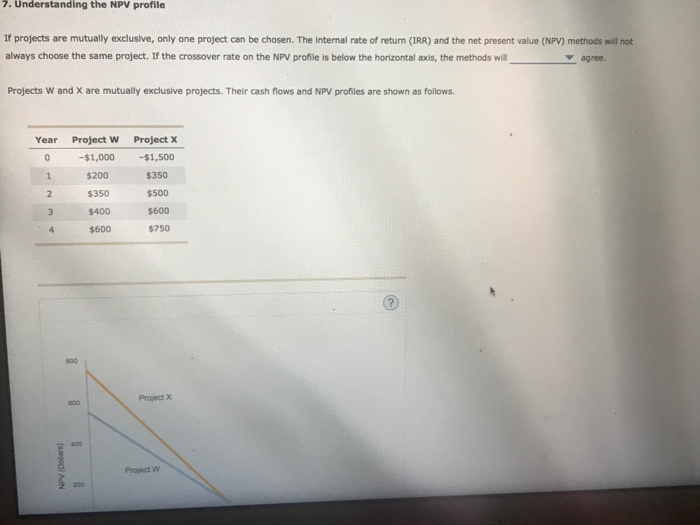

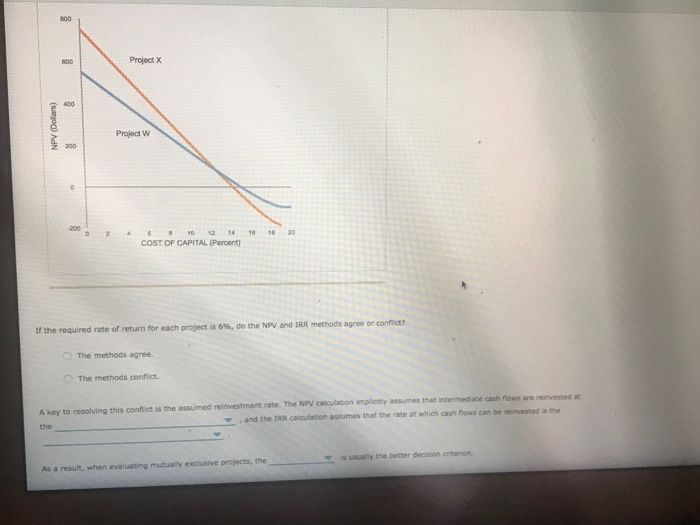

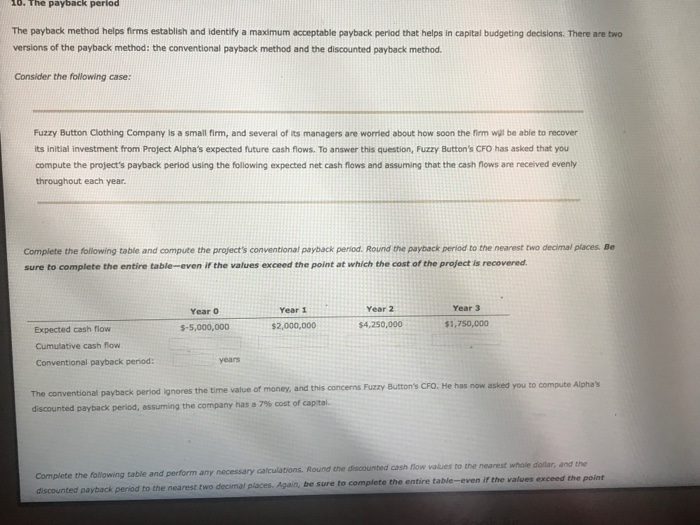

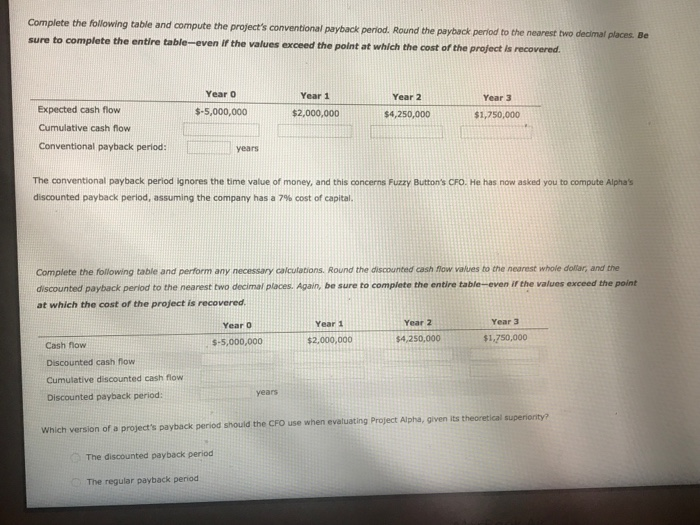

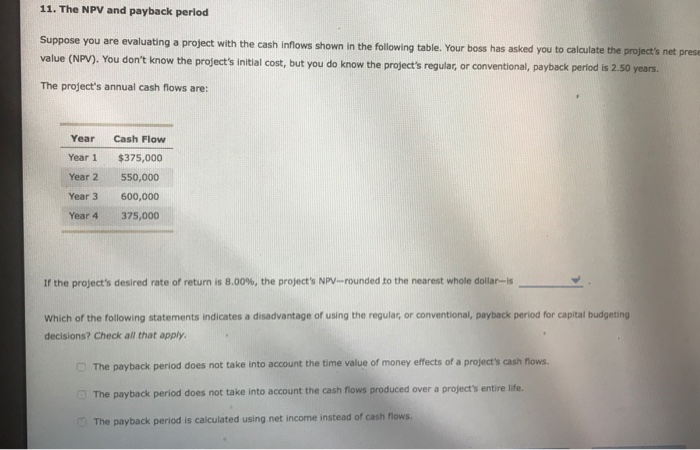

4. Net present value method McCall Engineering is evaluating a proposed capital budgeting project that will require an initial investment of $120,000. The project is expected to generate the following net cash flows: Year Cash Flow $37,600 $50,500 3 $45,000 $41,900 2 Assume the desired rate of return on a project of this type is 10%. The net present value of this project is Suppose McCall Engineering has enough capital to fund the project, and the project is not competing for funding with other projects. Should McCall Engineering accept or reject this project? Accept the project Reject the project L3 6. Understanding the IRR and NPV The net present value (NPV) and internal rate of return (IRR) methods of investment analysis are interrelated and are sometimes used together to make capital budgeting decisions. Consider the case of Blue Hamster Manufacturing Inc.: Last Tuesday, Blue Hamster Manufacturing Inc. lost a portion of its planning and financial data when its server and its backup server crashed. The company's CFO remembers that the internal rate of return (IRR) of Project Zeta is 13.80%, but he can't recall how much Blue Hannster originally invested in the project nor the project's net present value (NPV). However, he found a note that contained the annual net cash flows expected to be generated by Project Zeta. They are: Year Cash Flow $1,800,000 2 3,375,000 3 3,375,000 4 3,375,000 CFO has asked you to compute Project Zeta's initial investment using the nformation currenty available to you. He has The suggestions and observations . A project's IRR represents the return the project would generate when its NPV is zero or the discounted value of its cash inflows equals the discounted value of its cash outflows-when the cash flows are discounted using the project's IRR . The level of risk exhibited by Project Zeta is the same as that exhibited by the company's average project, which means that Project Zeta's net cash flows can be discounted using Blue Hamster's 8.00% desired rate of return. (both rounded to the nearest whole ,and its NPV is Given the data and hints, Project Zeta's initial investment is dollar). 7. Understanding the NPV profile If projects are mutually exclusive, only one project can be chosen. The internal rate of return (IRR) and the net present value (NPV) methods will not always choose the same project. If the crossover rate on the NPV profile is below the horizontal axis, the methods will agree Projects W and X are mutually exclusive projects. Their cash flows and NPV profiles are shown as follows. Year Project W Project x -$1,000 $1,500 $200 $350 $400$600 $600 350 $500 $750 800 Project X Project W 800 Project X 800 Project W 0 2 410 12 14 18 18 2 COST OF CAPITAL (Percent NPV and IRR methods agree or cornet? If the required rate of return for each project is 6%. do the The methods agree. The methods conflict A key to resolving this conftlict is the assumed reinvestment rate. The NPV caiculation implicitly assumes that intermedaze cash flows an the ,and the IRR calculation assumes that the rate at which cash flows can be moted ithe is usually the better decision critenion As a result, when evaluating mutualy exclusive projects, the 0. The payback perlod The payback method helps frms establish and identify a maximum acceptable payback period that helps in capital budgeting decisions. There are two versions of the payback method: the conventional payback method and the discounted payback method. Consider the following case: Fuzzy Button Clothing Company is a small firm, and several of its managers are worrled about how soon the firm wl be able to recover its initial investment from Project Alpha's expected future cash flows. To answer this question, Fuzzy Button's CFO has asked that you compute the project's payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year Complete the following table and compute the project's conventional payback period. Round the payback period to the nearest two decimal places. Be sure to complete the entire table-even if the values exceed the point at which the cost of the project is recovered Year 3 Year 2 Year 1 Year o $4,250,000 $1,750,00o $2,000,000 S-5,000,000 Expected cash flovw Cumulative cash flow Conventional payback period: years the time value of money, and this concerns Fuzzy Button's CFO. He has now asked you to compute Alphas The conventional payback period ignores the of discounted payback period, assuming the company has a 7% cist of capital Complete the following table and perform any necessary calculations. discounted payback period to the nearest two decimal places. Again, be sure to complete the Round the discounted cash flow values to the nearest whole dollar, and the exceed the point entire table-even if the values Complete the following table and compute the project's conventional payback period. Round sure to complete the entire table-even values the payback period to the nearest two decimal places. Be If the values exceed the point at which the cost of the project is recovered. Year o Year 2 Year 1 Year 3 Expected cash flow Cumulative cash flow Conventional payback period: s-5,000,000 $2,000,00D $4,250,000 $1,750,000 years The conventional payback period ignores the time value of money, and this concerns Fuzzy Button's CFO. He has now asked you to compute Alpha's discounted payback period, assuming the company has a 7% cost of capital. Complete the following table and perform any necessary calcutations. Round the discounted cash flow values to the nearest whole dollar, and the discounted payback period to the nearest two decimal places. Again, be sure to complete the entire table-even if the values exceed the point at which the cost of the project is recovered Year 3 Year 2 Year 1 Year 0 $1,750,000 $2,000,000 $4,250,000 $-5,000,000 Cash flow Discounted cash flow Cumulative discounted cash flow Discounted payback period: years Which version of a project's payback period should the CFO use when evaluating Project Alpha, given its theoretical superionity? The discounted payback period The regular payback period 11. The NPV and payback perlod Suppose you are evaluating a value (NPV), You don't know the project's initial cost, but you do know the projet's regulac, or conventional, payback perlod is 2. 50 years. The project's annual cash flows are: project with the cash inflows shown in the following table. Your boss has asked you to calculate the project's net pres Year Cash Flow Year 1 $375,000 Year 2 550,000 Year 3 600,000 Year 4 375,000 If the project's desired rate of return is 8.00% the project's NPV rounded to the nearest whole dollar is Which of the following statements indicates a disadvantage of using the regular, or conventional, payback period for capital budgeting decisions? Check all that apply The payback period does not take into account the time value of money effects of a project's cash flows. The payback period does not take into account the cash flows produced over a project's entire life. The payback period is calculated using net income instead or cash nows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts