Question: 4. Now we can use Solver to maximize this expression by changing the weight of the equity input cell. The constraint is that the

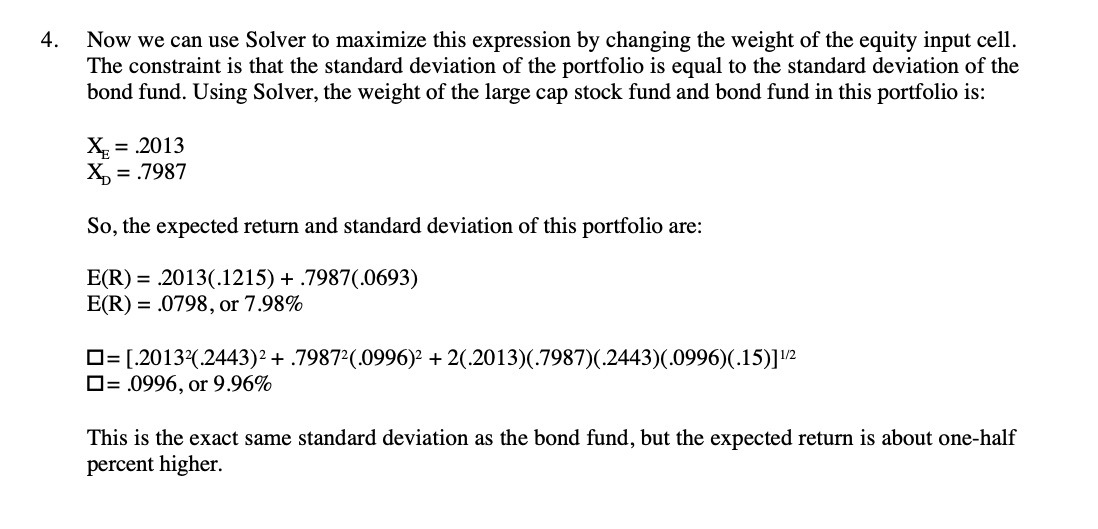

4. Now we can use Solver to maximize this expression by changing the weight of the equity input cell. The constraint is that the standard deviation of the portfolio is equal to the standard deviation of the bond fund. Using Solver, the weight of the large cap stock fund and bond fund in this portfolio is: X=.2013 = .7987 So, the expected return and standard deviation of this portfolio are: E(R)=.2013(.1215) + .7987(.0693) E(R) .0798, or 7.98% [.2013.2443)2 + .79872(.0996) + 2(.2013)(.7987)(.2443)(.0996)(.15)] 1/2 = .0996, or 9.96% This is the exact same standard deviation as the bond fund, but the expected return is about one-half percent higher.

Step by Step Solution

There are 3 Steps involved in it

To maximize the expression by changing the weight of the equity input cell the following steps were ... View full answer

Get step-by-step solutions from verified subject matter experts