Question: 4. Numerical problem I (20p) Suppose the interest rate is 5%, the time horizon is 30 years, the marginal tax rate on ordinary income at

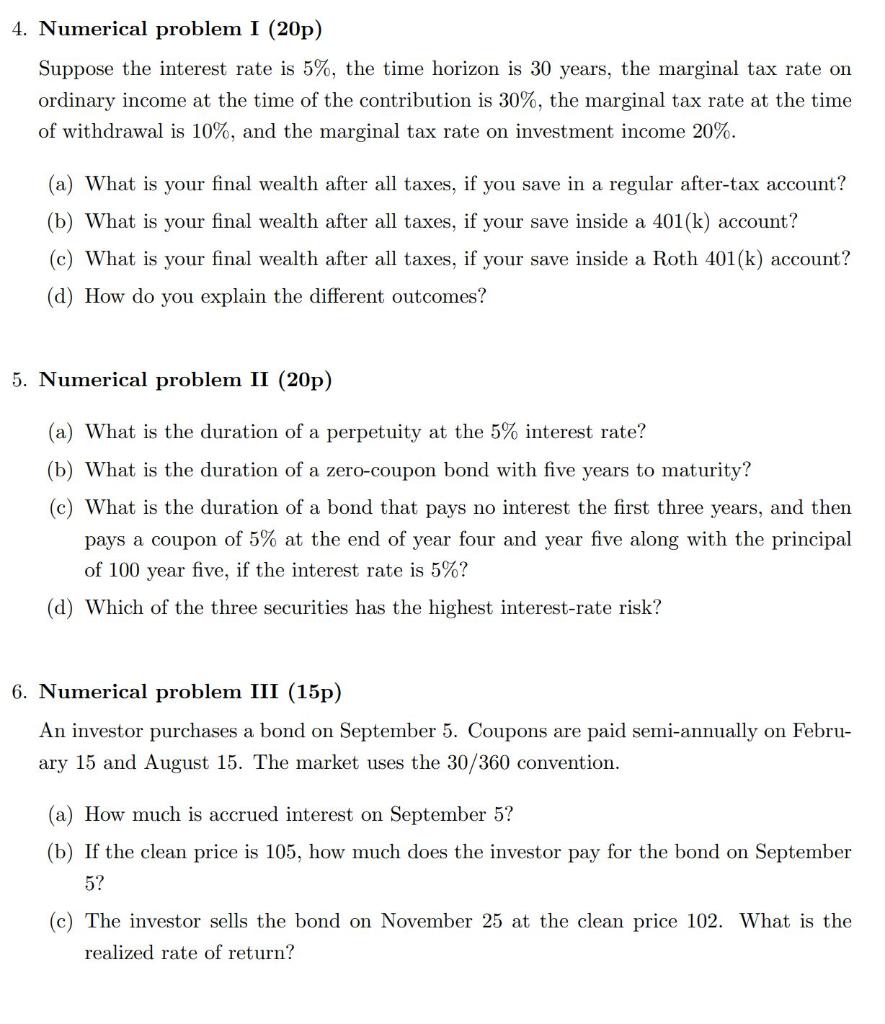

4. Numerical problem I (20p) Suppose the interest rate is 5%, the time horizon is 30 years, the marginal tax rate on ordinary income at the time of the contribution is 30%, the marginal tax rate at the time of withdrawal is 10%, and the marginal tax rate on investment income 20%. (a) What is your final wealth after all taxes, if you save in a regular after-tax account? (b) What is your final wealth after all taxes, if your save inside a 401(k) account? (c) What is your final wealth after all taxes, if your save inside a Roth 401(k) account? (d) How do you explain the different outcomes? 5. Numerical problem II (20p) (a) What is the duration of a perpetuity at the 5% interest rate? (b) What is the duration of a zero-coupon bond with five years to maturity? (c) What is the duration of a bond that pays no interest the first three years, and then pays a coupon of 5% at the end of year four and year five along with the principal of 100 year five, if the interest rate is 5%? (d) Which of the three securities has the highest interest-rate risk? 6. Numerical problem III (15p) An investor purchases a bond on September 5. Coupons are paid semi-annually on Febru- ary 15 and August 15. The market uses the 30/360 convention. (a) How much is accrued interest on September 5? (b) If the clean price is 105, how much does the investor pay for the bond on September 5? (c) The investor sells the bond on November 25 at the clean price 102. What is the realized rate of return? 4. Numerical problem I (20p) Suppose the interest rate is 5%, the time horizon is 30 years, the marginal tax rate on ordinary income at the time of the contribution is 30%, the marginal tax rate at the time of withdrawal is 10%, and the marginal tax rate on investment income 20%. (a) What is your final wealth after all taxes, if you save in a regular after-tax account? (b) What is your final wealth after all taxes, if your save inside a 401(k) account? (c) What is your final wealth after all taxes, if your save inside a Roth 401(k) account? (d) How do you explain the different outcomes? 5. Numerical problem II (20p) (a) What is the duration of a perpetuity at the 5% interest rate? (b) What is the duration of a zero-coupon bond with five years to maturity? (c) What is the duration of a bond that pays no interest the first three years, and then pays a coupon of 5% at the end of year four and year five along with the principal of 100 year five, if the interest rate is 5%? (d) Which of the three securities has the highest interest-rate risk? 6. Numerical problem III (15p) An investor purchases a bond on September 5. Coupons are paid semi-annually on Febru- ary 15 and August 15. The market uses the 30/360 convention. (a) How much is accrued interest on September 5? (b) If the clean price is 105, how much does the investor pay for the bond on September 5? (c) The investor sells the bond on November 25 at the clean price 102. What is the realized rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts