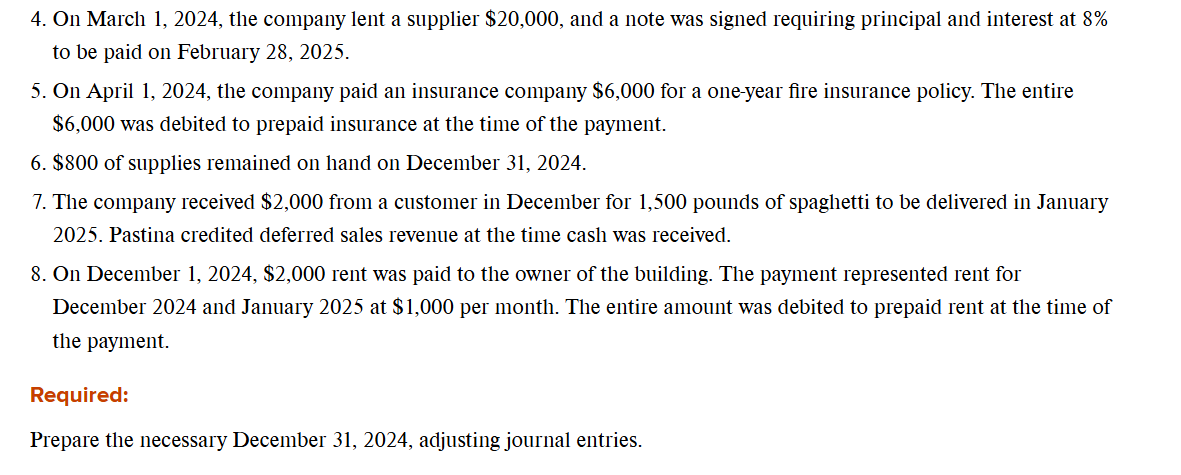

Question: 4 . On March 1 , 2 0 2 4 , the company lent a supplier ( $ 2 0 , 0 0

On March the company lent a supplier $ and a note was signed requiring principal and interest at to be paid on February

On April the company paid an insurance company $ for a oneyear fire insurance policy. The entire $ was debited to prepaid insurance at the time of the payment.

$ of supplies remained on hand on December

The company received $ from a customer in December for pounds of spaghetti to be delivered in January Pastina credited deferred sales revenue at the time cash was received.

On December $ rent was paid to the owner of the building. The payment represented rent for December and January at $ per month. The entire amount was debited to prepaid rent at the time of the payment.

Required:

Prepare the necessary December adjusting journal entries.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock