Question: 4. (Option leverage: put option avoffsirelication:% margin) Robert would like to speculate on a possible decline in the stock price of GOOGL (Google; Alphabet Inc.

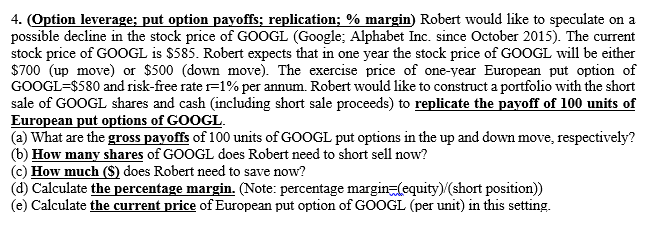

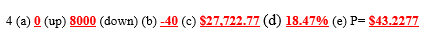

4. (Option leverage: put option avoffsirelication:% margin) Robert would like to speculate on a possible decline in the stock price of GOOGL (Google; Alphabet Inc. since October 2015). The current stock price of GOOGL is $585. Robert expects that in one year the stock price of GOOGL will be either $700 (up move) or $500 (down move). The exercise price of one-year European put option of GOOGL-S580 and risk-free rate F1 % per annum. Robert would like to construct a portfolio with the short sale of GOoGL shares and cash (including short sale proceeds) to replicate the payoff of 100 units of European put options of GOOGI (a) What are the gross payoffs of 100 units of GOOGL put options in the up and down move, respectively? (b) How many shares of GOOGL does Robert need to short sell now? (c) How much (S) does Robert need to save now? (d) Calculate the percentage margin. (Note: percentage margin equity) (short position)) (e) Calculate the current price of European put option of GOOGL (per unit) in this setting. 4. (Option leverage: put option avoffsirelication:% margin) Robert would like to speculate on a possible decline in the stock price of GOOGL (Google; Alphabet Inc. since October 2015). The current stock price of GOOGL is $585. Robert expects that in one year the stock price of GOOGL will be either $700 (up move) or $500 (down move). The exercise price of one-year European put option of GOOGL-S580 and risk-free rate F1 % per annum. Robert would like to construct a portfolio with the short sale of GOoGL shares and cash (including short sale proceeds) to replicate the payoff of 100 units of European put options of GOOGI (a) What are the gross payoffs of 100 units of GOOGL put options in the up and down move, respectively? (b) How many shares of GOOGL does Robert need to short sell now? (c) How much (S) does Robert need to save now? (d) Calculate the percentage margin. (Note: percentage margin equity) (short position)) (e) Calculate the current price of European put option of GOOGL (per unit) in this setting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts