Question: 4. Option pricing model - Binomial approach Aa Aa E Learn Corp. (Ticker: LC), an education technology company, is considered to be one of the

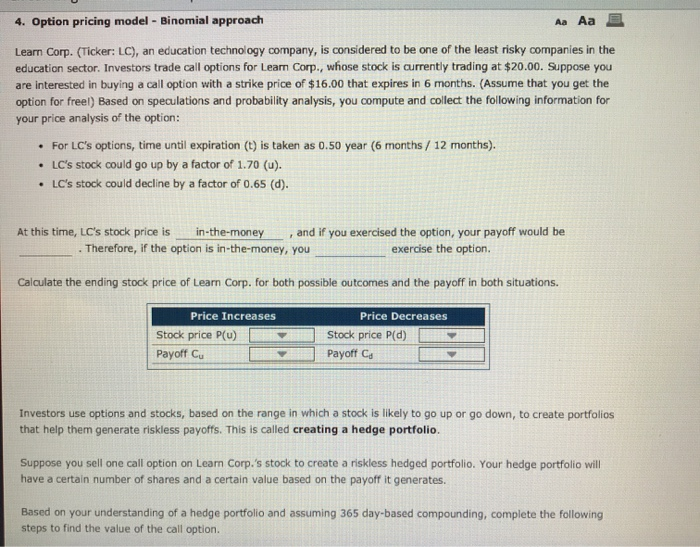

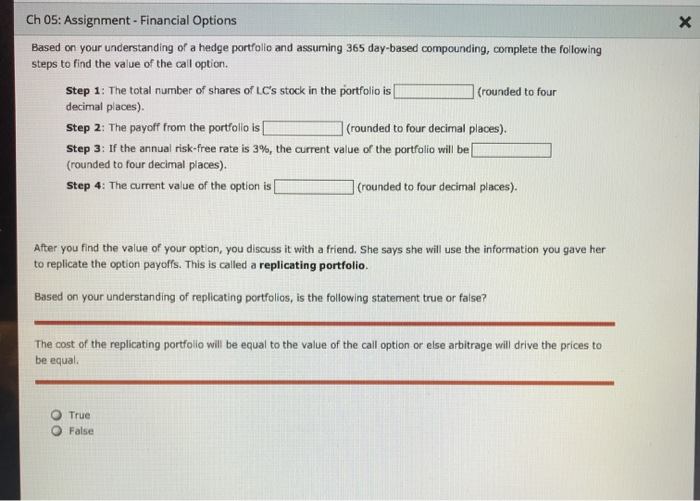

4. Option pricing model - Binomial approach Aa Aa E Learn Corp. (Ticker: LC), an education technology company, is considered to be one of the least risky companies in the education sector. Investors trade call options for Learn Corp., whose stock is currently trading at $20.00. Suppose you are interested in buying a call option with a strike price of $16.00 that expires in 6 months. (Assume that you get the option for freel) Based on speculations and probability analysis, you compute and collect the following information for your price analysis of the option: For LC's options, time until expiration (t) is taken as 0.50 year (6 months / 12 months). LC's stock could go up by a factor of 1.70 (u). LC's stock could decline by a factor of 0.65 (d). At this time, LC's stock price is in-the-money , and if you exercised the option, your payoff would be . Therefore, if the option is in-the-money, you exercise the option. Calculate the ending stock price of Learn Corp. for both possible outcomes and the payoff in both situations. Price Increases Stock price P(U) Payoff cu Price Decreases Stock price P(d) Payoff Cd Investors use options and stocks, based on the range in which a stock is likely to go up or go down, to create portfolios that help them generate riskless payoffs. This is called creating a hedge portfolio. Suppose you sell one call option on Learn Corp.'s stock to create a riskless hedged portfolio. Your hedge portfolio will have a certain number of shares and a certain value based on the payoff it generates. Based on your understanding of a hedge portfolio and assuming 365 day-based compounding, complete the following steps to find the value of the call option. Ch 05: Assignment - Financial Options X Based on your understanding of a hedge portfolio and assuming 365 day-based compounding, complete the following steps to find the value of the call option. Step 1: The total number of shares of LC's stock in the portfolio is (rounded to four decimal places). Step 2: The payoff from the portfolio is (rounded to four decimal places). Step 3: If the annual risk-free rate is 3%, the current value of the portfolio will be (rounded to four decimal places). Step 4: The current value of the option is L IAA (rounded to four decimal places). After you find the value of your option, you discuss it with a friend. She says she will use the information you gave her to replicate the option payoffs. This is called a replicating portfolio Based on your understanding of replicating portfolios, is the following statement true or false? The cost of the replicating portfolio will be equal to the value of the call option or else arbitrage will drive the prices to be equal. SS O True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts