Question: 4. Option pricing model - Binomial approach Learn Corp. (Ticker: LC), an education technology company, is considered to be one of the least risky companies

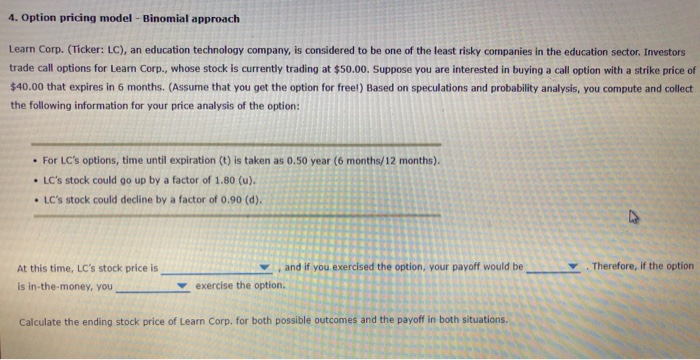

4. Option pricing model - Binomial approach Learn Corp. (Ticker: LC), an education technology company, is considered to be one of the least risky companies in the education sector. Investors trade call options for Learn Corp., whose stock is currently trading at $50.00. Suppose you are interested in buying a call option with a strike price of $40.00 that expires in 6 months. (Assume that you get the option for freel) Based on speculations and probability analysis, you compute and collect the following information for your price analysis of the option: For LC's options, time until expiration (t) is taken as 0.50 year (6 months/12 months). LC's stock could go up by a factor of 1.80 (u). LC's stock could decline by a factor of 0.90 (d). and if you exercised the option, your payoff would be refore, if the option At this time, LC's stock price is is in-the-money, you exercise the option. Calculate the ending stock price of Learn Corp. for both possible outcomes and the payoff in both situations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts