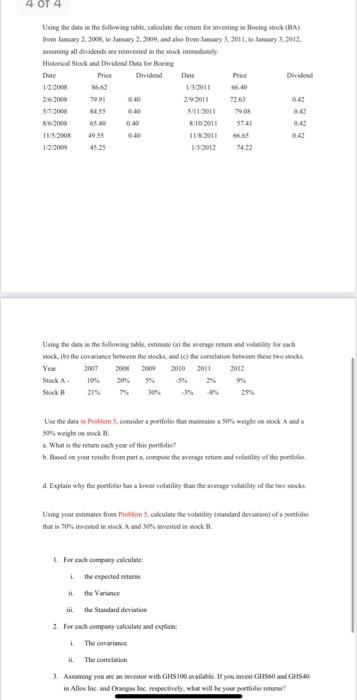

Question: 4. OT 4 Using the data in the following table, calculate the room for investing in Bocing stock (BA) trom January 2, 2008, Samry 2.2009,

4. OT 4 Using the data in the following table, calculate the room for investing in Bocing stock (BA) trom January 2, 2008, Samry 2.2009, and also from Smary, 2011. January 3, 2012 sing all dividende wesented in the stock immediately Histoical Stock and Dividend Data for Boeing Dale Price Divideod Dale Price 12.2008 1.3.2011 262000 39 2011 72.63 57300 455 0.40 11/2011 7903 0.43 9.2008 65.000.00 N10/2011 5741 0.42 4655 6:40 11/2011 12.2009 13.2012 7422 tising the data in the following table, estimaal te wengetum diyorsach sk. he counce between the stocks, and (c) to come between these two stocks Yew 2007 2008 2009 2010 2011 2012 Stock Stock Use the data in Problems.comider a poetfolio that intains a 50 weight stock Aanda 5 weight on sock What is the retumeah you of this portfolio b. Based on your route from porta, compute the average means and volatility of the portfolio 4. Explain why the perfein has a lower volatility than the average vedutility of the ticke Using your estimates from Problem sollte the volatility and dev) of a patio that is 70% invested in Meck Advested in veck For each company calle the expected returns the Vorunce in the Standard devia 2. For each company calculate and explain The covariance The correlation 3. Asming you weavestor with GHS100 available. If you lovet GHS GHS in Alles Inc. and Orange Inc. respectively, what will be your portfolitum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts