Question: 4. Palmer Corp. issued callable bonds with a face value of $200,000 and a coupon rate of 6%. The bond matures in 4 years and

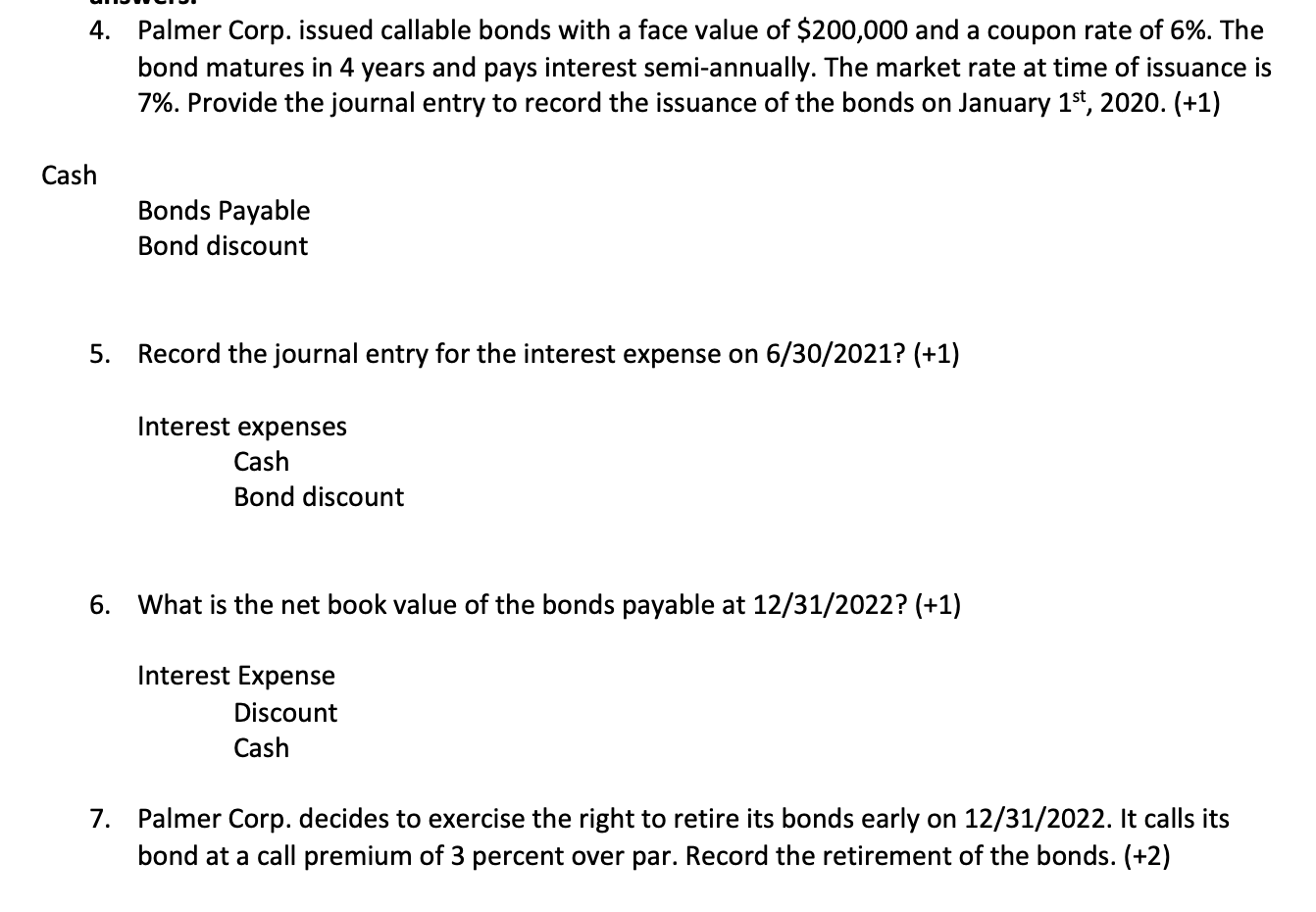

4. Palmer Corp. issued callable bonds with a face value of $200,000 and a coupon rate of 6%. The bond matures in 4 years and pays interest semi-annually. The market rate at time of issuance is 7\%. Provide the journal entry to record the issuance of the bonds on January 1st,2020.(+1) Bonds Payable Bond discount 5. Record the journal entry for the interest expense on 6/30/2021? (+1) Interest expenses Cash Bond discount 6. What is the net book value of the bonds payable at 12/31/2022?(+1) Interest Expense Discount Cash 7. Palmer Corp. decides to exercise the right to retire its bonds early on 12/31/2022. It calls its bond at a call premium of 3 percent over par. Record the retirement of the bonds. (+2) 4. Palmer Corp. issued callable bonds with a face value of $200,000 and a coupon rate of 6%. The bond matures in 4 years and pays interest semi-annually. The market rate at time of issuance is 7\%. Provide the journal entry to record the issuance of the bonds on January 1st,2020.(+1) Bonds Payable Bond discount 5. Record the journal entry for the interest expense on 6/30/2021? (+1) Interest expenses Cash Bond discount 6. What is the net book value of the bonds payable at 12/31/2022?(+1) Interest Expense Discount Cash 7. Palmer Corp. decides to exercise the right to retire its bonds early on 12/31/2022. It calls its bond at a call premium of 3 percent over par. Record the retirement of the bonds. (+2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts