Question: 4 - part b - i Below is a table with four different scenarios for a taxpayer who opts to sell several different types of

part bi

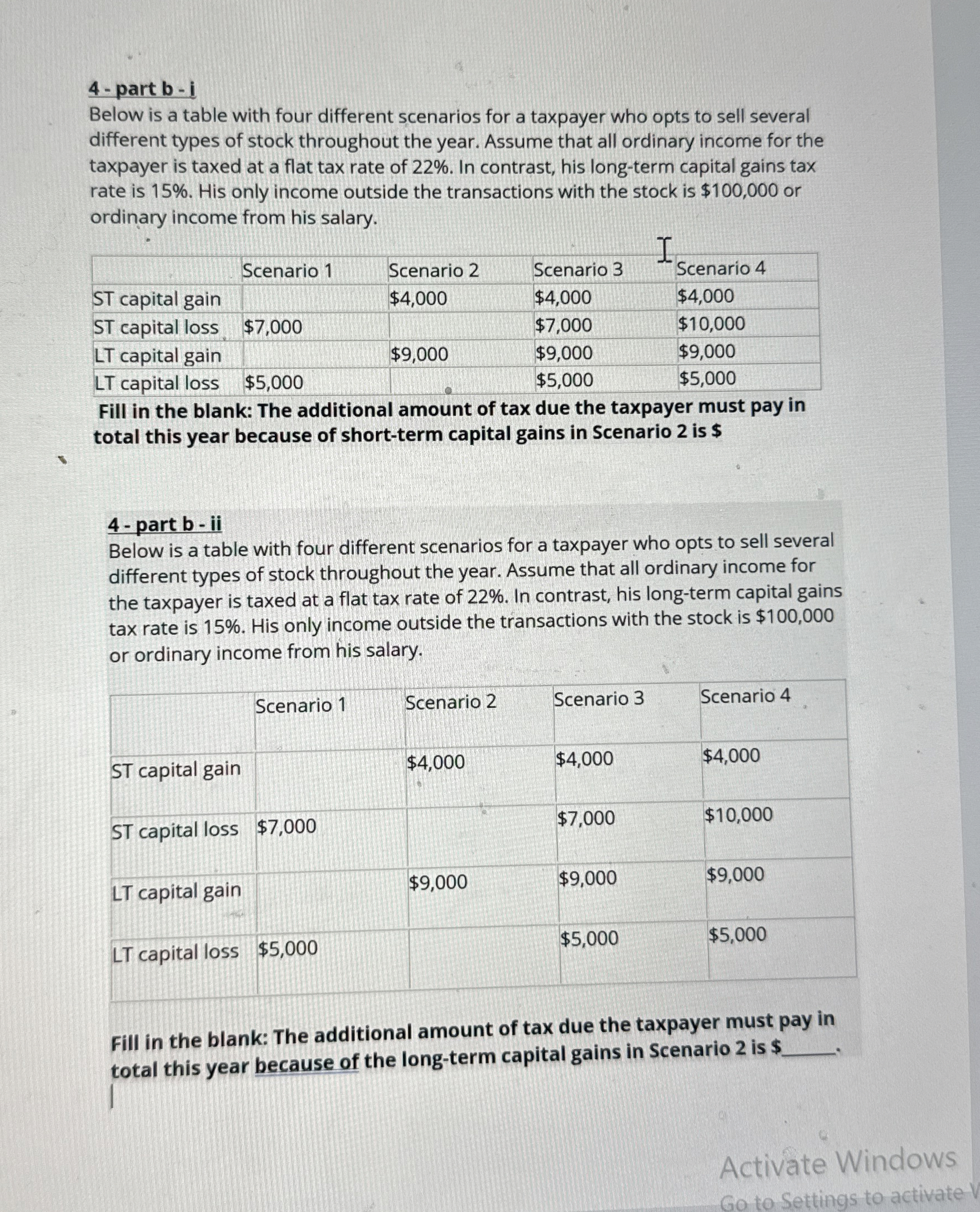

Below is a table with four different scenarios for a taxpayer who opts to sell several

different types of stock throughout the year. Assume that all ordinary income for the

taxpayer is taxed at a flat tax rate of In contrast, his longterm capital gains tax

rate is His only income outside the transactions with the stock is $ or

ordinary income from his salary.

Fill in the blank: The additional amount of tax due the taxpayer must pay in

total this year because of shortterm capital gains in Scenario is $

part b ii

Below is a table with four different scenarios for a taxpayer who opts to sell several

different types of stock throughout the year. Assume that all ordinary income for

the taxpayer is taxed at a flat tax rate of In contrast, his longterm capital gains

tax rate is His only income outside the transactions with the stock is $

or ordinary income from his salary.

Fill in the blank: The additional amount of tax due the taxpayer must pay in

total this year because of the longterm capital gains in Scenario is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock