Question: 4 part question!! what other information is needed? Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2021. In the process

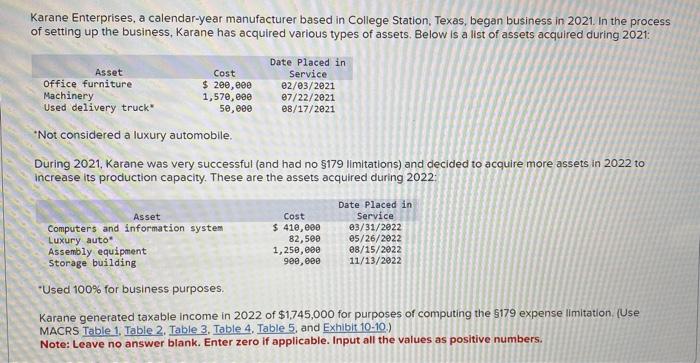

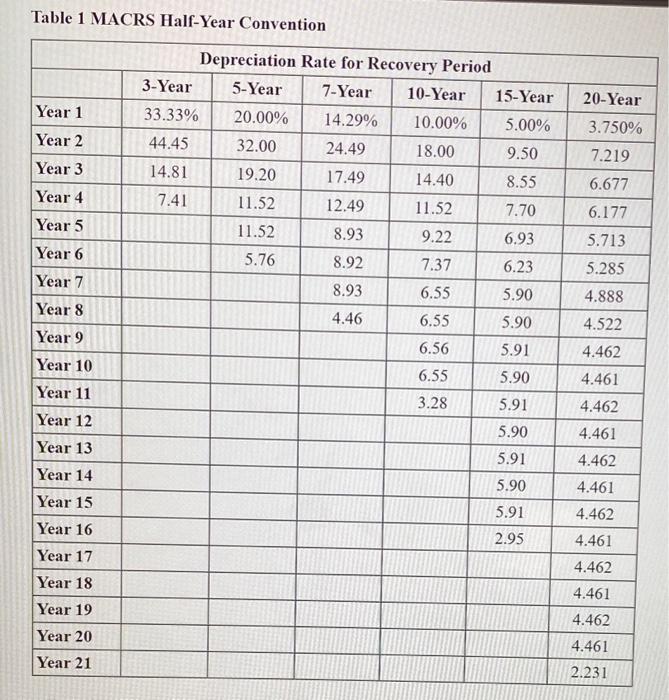

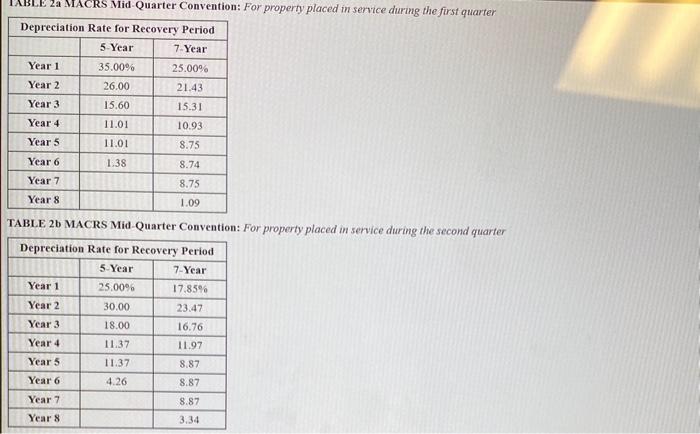

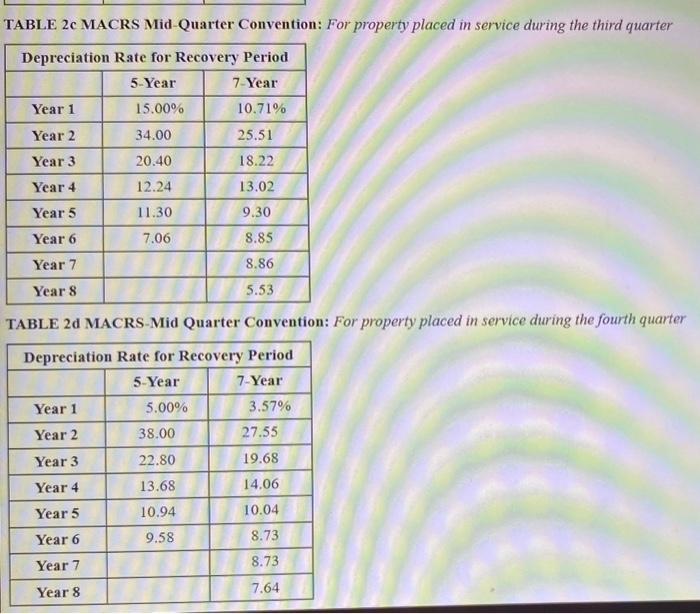

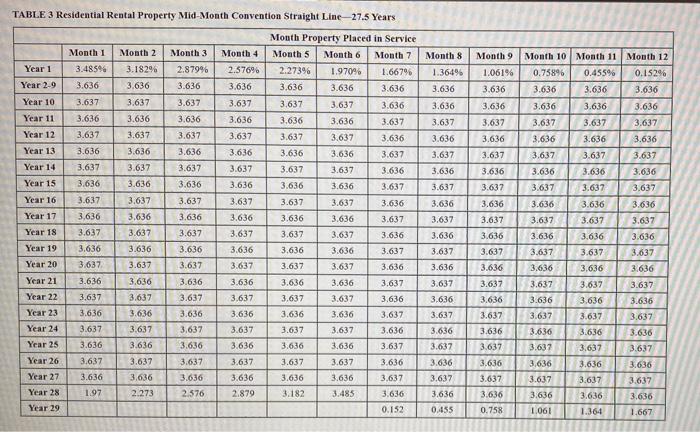

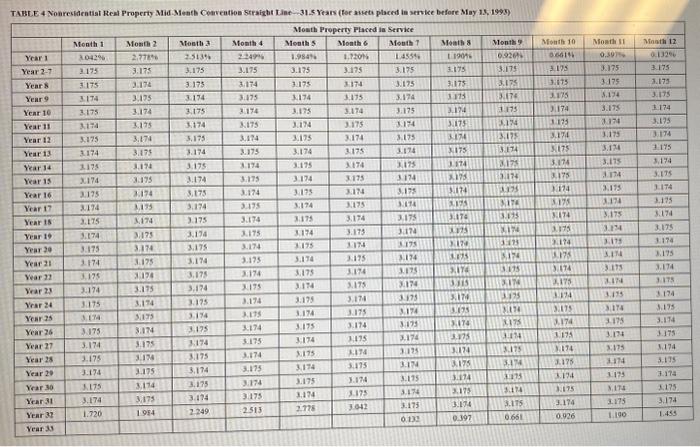

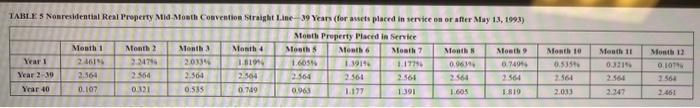

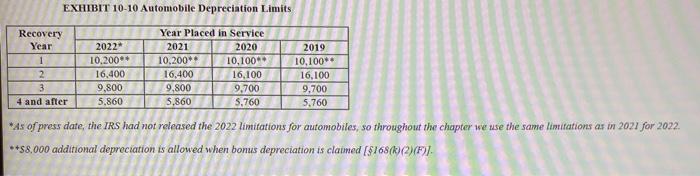

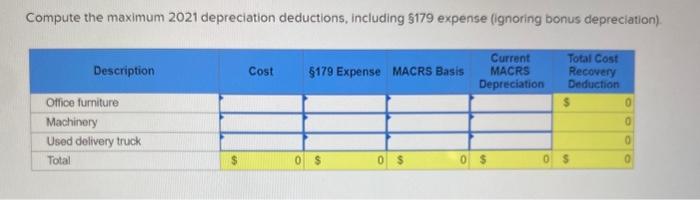

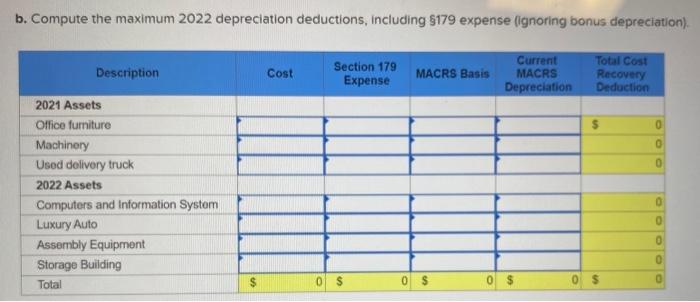

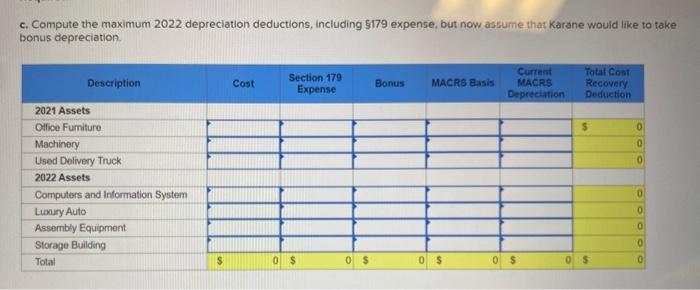

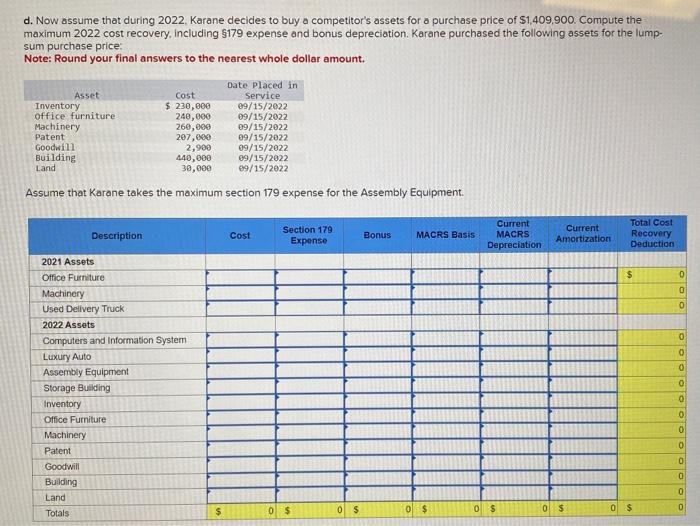

Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2021. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2021 : "Not considered a luxury automobile. increase its production capacity. These are the assets acquired during 2022 : -Used 100% for business purposes. Karane generated taxable income in 2022 of $1,745,000 for purposes of computing the $179 expense llmitation. (Use MACRS Table 1. Table 2, Table 3, Table 4, Table 5, and Exhibit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. Table 1 MACRS Half-Vear Convantion TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABI.E 3 Residential Rental Property Mid-Month Convention Straight Line- -27.5 Years TABLE 4 Nonresidentist Real Property Mid Mentb Coaventhos straight Liae -31.5 Years (for aheti placed in service before May 15, 1998) IABt \&: 5 Nonresidential Real Freperty Mtid-Month Convention biraight I.ine--39 Years (for ascts placed in service on or after May 13, 1993) EXHIBIT 10-10 Automobile Depreciation Limits *As of press date, the IRS had not released the 2022 limitations for automobiles, so throughout the chapter we tse the same limitations as in 2021 for 2022. * $8,000 additional depreciation is allowed when bonus depreciation is clained [$/68(k)(2)(F)]. Compute the maximum 2021 depreciation deductions, including $179 expense (ignoring bonus depreciation). b. Compute the maximum 2022 depreciation deductions, including $179 expense (ignoring bonus depreciation). c. Compute the maximum 2022 depreciation deductions, including $179 expense, but now assume that Karane would like to take bonus depreciation d. Now assume that during 2022, Karane decides to buy a competitor's assets for a purchase price of $1,409,900. Compute the maximum 2022 cost recovery, including $179 expense and bonus depreciation. Karane purchased the following ossets for the lumpsum purchase price: Note: Round your final answers to the nearest whole dollar amount. Assume that Karane takes the maximum section 179 expense for the Assembly Equipment. Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2021. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2021 : "Not considered a luxury automobile. increase its production capacity. These are the assets acquired during 2022 : -Used 100% for business purposes. Karane generated taxable income in 2022 of $1,745,000 for purposes of computing the $179 expense llmitation. (Use MACRS Table 1. Table 2, Table 3, Table 4, Table 5, and Exhibit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. Table 1 MACRS Half-Vear Convantion TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABI.E 3 Residential Rental Property Mid-Month Convention Straight Line- -27.5 Years TABLE 4 Nonresidentist Real Property Mid Mentb Coaventhos straight Liae -31.5 Years (for aheti placed in service before May 15, 1998) IABt \&: 5 Nonresidential Real Freperty Mtid-Month Convention biraight I.ine--39 Years (for ascts placed in service on or after May 13, 1993) EXHIBIT 10-10 Automobile Depreciation Limits *As of press date, the IRS had not released the 2022 limitations for automobiles, so throughout the chapter we tse the same limitations as in 2021 for 2022. * $8,000 additional depreciation is allowed when bonus depreciation is clained [$/68(k)(2)(F)]. Compute the maximum 2021 depreciation deductions, including $179 expense (ignoring bonus depreciation). b. Compute the maximum 2022 depreciation deductions, including $179 expense (ignoring bonus depreciation). c. Compute the maximum 2022 depreciation deductions, including $179 expense, but now assume that Karane would like to take bonus depreciation d. Now assume that during 2022, Karane decides to buy a competitor's assets for a purchase price of $1,409,900. Compute the maximum 2022 cost recovery, including $179 expense and bonus depreciation. Karane purchased the following ossets for the lumpsum purchase price: Note: Round your final answers to the nearest whole dollar amount. Assume that Karane takes the maximum section 179 expense for the Assembly Equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts