Question: 4. Payroll is distributed every Friday; your weekly payroll is $55,000. The last day of the month falls on a Wednesday. Your accountant told you

4. Payroll is distributed every Friday; your weekly payroll is $55,000. The last day of the month falls on a Wednesday. Your accountant told you to DR Salaries Expense and CR Salaries Payable for $27,000. What, if any, correcting entry must be made? If no correcting entry is made, what is the impact to the financial statements?

11. Interest on a note payable accrued $200 of interest at the end of the period. The accountant DR Interest Receivable and CR Interest Payable. What correcting entry must be made?

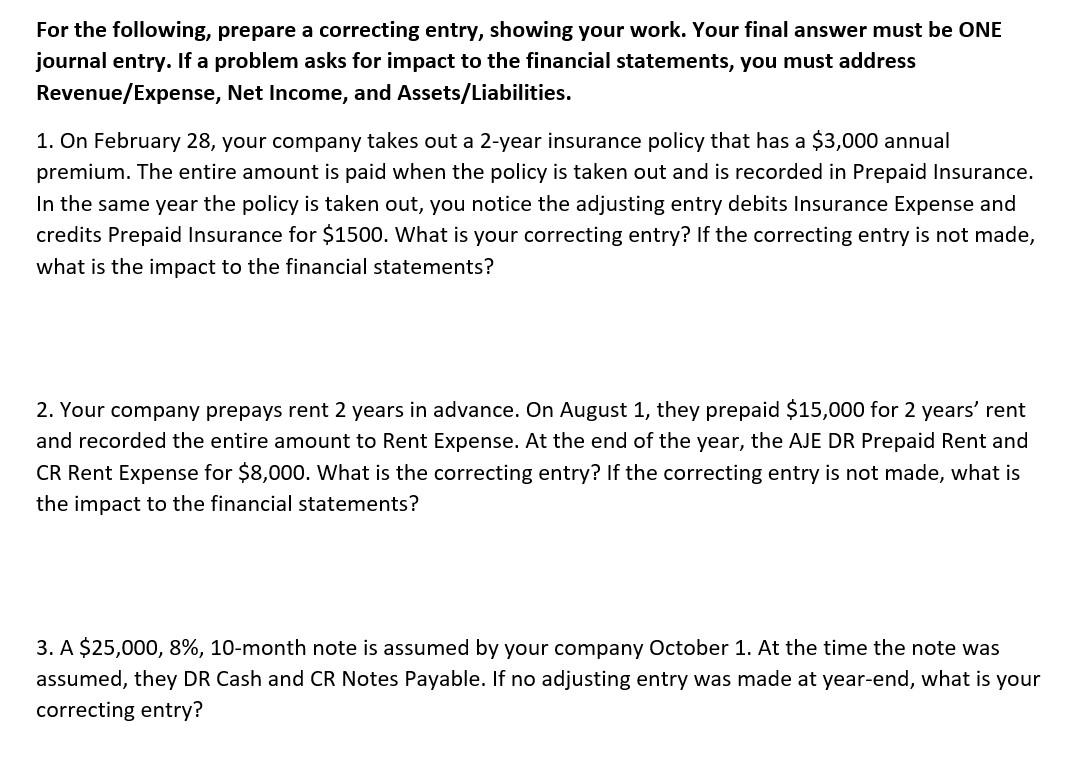

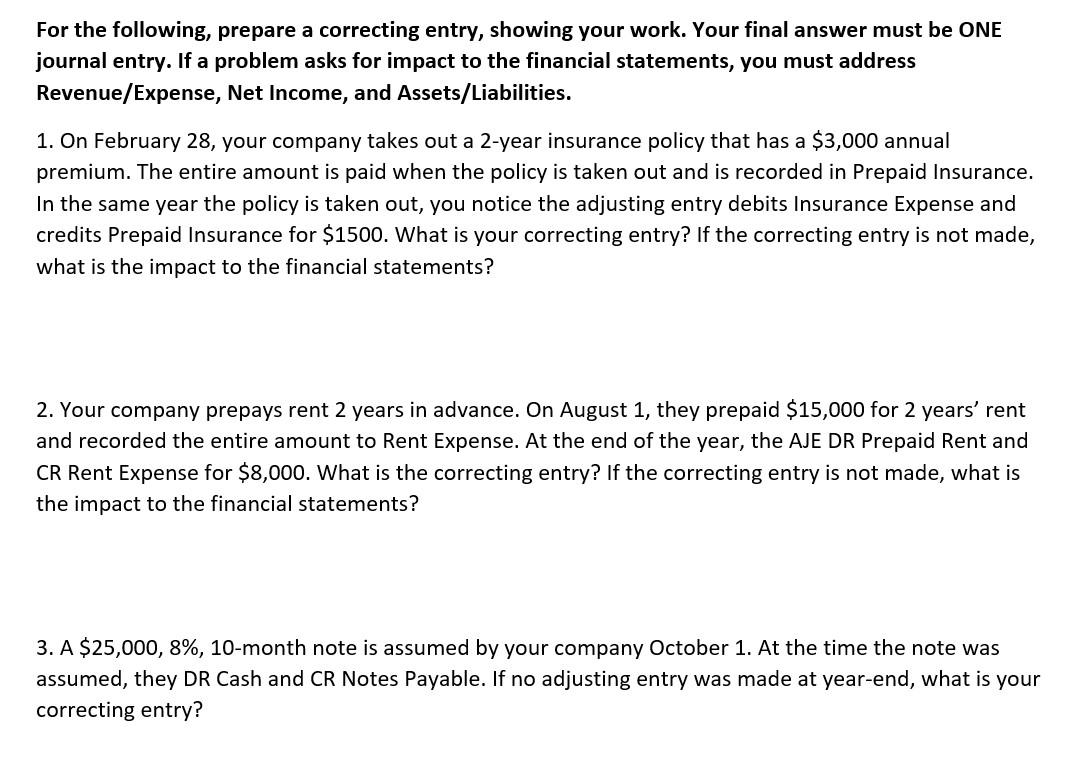

For the following, prepare a correcting entry, showing your work. Your final answer must be ONE journal entry. If a problem asks for impact to the financial statements, you must address Revenue/Expense, Net Income, and Assets/Liabilities. 1. On February 28, your company takes out a 2-year insurance policy that has a $3,000 annual premium. The entire amount is paid when the policy is taken out and is recorded in Prepaid Insurance. In the same year the policy is taken out, you notice the adjusting entry debits Insurance Expense and credits Prepaid Insurance for $1500. What is your correcting entry? If the correcting entry is not made, what is the impact to the financial statements? 2. Your company prepays rent 2 years in advance. On August 1, they prepaid $15,000 for 2 years' rent and recorded the entire amount to Rent Expense. At the end of the year, the AJE DR Prepaid Rent and CR Rent Expense for $8,000. What is the correcting entry? If the correcting entry is not made, what is the impact to the financial statements? 3. A $25,000, 8%, 10-month note is assumed by your company October 1. At the time the note was assumed, they DR Cash and CR Notes Payable. If no adjusting entry was made at year-end, what is your correcting entry? For the following, prepare a correcting entry, showing your work. Your final answer must be ONE journal entry. If a problem asks for impact to the financial statements, you must address Revenue/Expense, Net Income, and Assets/Liabilities. 1. On February 28, your company takes out a 2-year insurance policy that has a $3,000 annual premium. The entire amount is paid when the policy is taken out and is recorded in Prepaid Insurance. In the same year the policy is taken out, you notice the adjusting entry debits Insurance Expense and credits Prepaid Insurance for $1500. What is your correcting entry? If the correcting entry is not made, what is the impact to the financial statements? 2. Your company prepays rent 2 years in advance. On August 1, they prepaid $15,000 for 2 years' rent and recorded the entire amount to Rent Expense. At the end of the year, the AJE DR Prepaid Rent and CR Rent Expense for $8,000. What is the correcting entry? If the correcting entry is not made, what is the impact to the financial statements? 3. A $25,000, 8%, 10-month note is assumed by your company October 1. At the time the note was assumed, they DR Cash and CR Notes Payable. If no adjusting entry was made at year-end, what is your correcting entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts