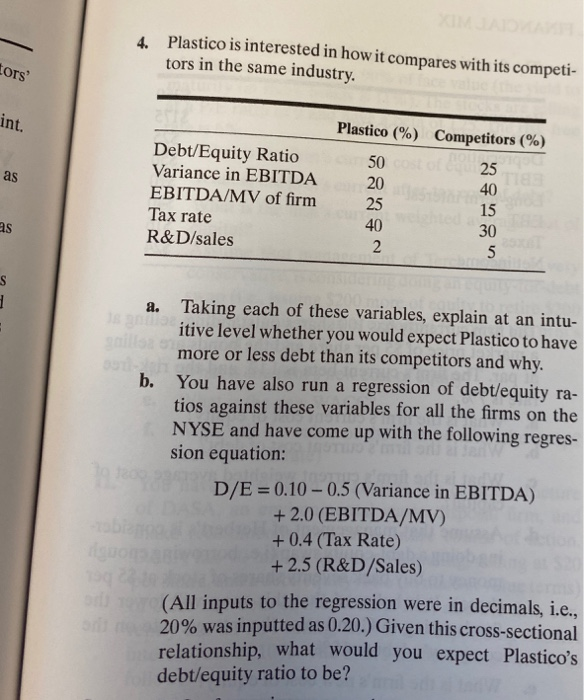

Question: 4. Plastico is interested in how it compares with its competi- tors in the same industry. tors int. Plastico (%) Competitors (%) as Debt/Equity Ratio

4. Plastico is interested in how it compares with its competi- tors in the same industry. tors int. Plastico (%) Competitors (%) as Debt/Equity Ratio Variance in EBITDA EBITDA/MV of firm Tax rate R&D/sales b. a. Taking each of these variables, explain at an intu- itive level whether you would expect Plastico to have more or less debt than its competitors and why. You have also run a regression of debt/equity ra- tios against these variables for all the firms on the NYSE and have come up with the following regres- sion equation: D/E = 0.10 -0.5 (Variance in EBITDA) + 2.0 (EBITDA/MV) +0.4 (Tax Rate) +2.5 (R&D/Sales) (All inputs to the regression were in decimals, i.e., 20% was inputted as 0.20.) Given this cross-sectional relationship, what would you expect Plastico's debt/equity ratio to be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts