Question: 4 Please explain formula why is it necessary to find payout ratio 1-0.4? why pay out ration multiply by dividend? 5 and 5.1 which formula

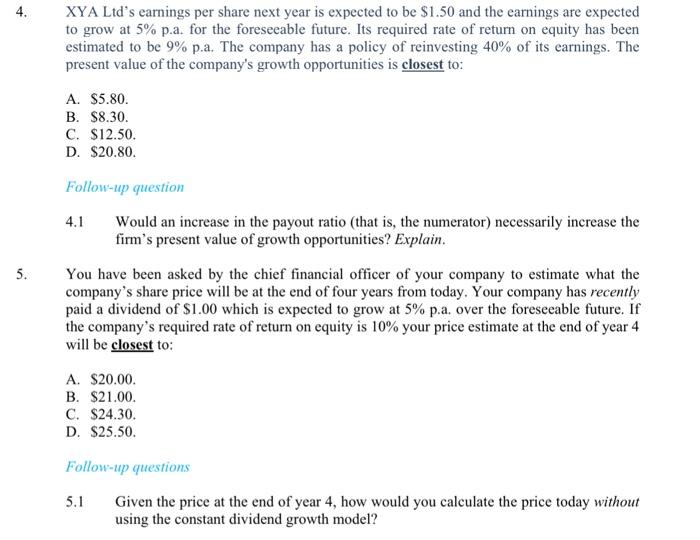

4. XYA Ltd's earnings per share next year is expected to be $1.50 and the earnings are expected to grow at 5% p.a. for the foreseeable future. Its required rate of return on equity has been estimated to be 9% p.a. The company has a policy of reinvesting 40% of its earnings. The present value of the company's growth opportunities is closest to: A. $5.80. B. $8.30. C. $12.50. D. $20.80. 5. Follow-up question 4.1 Would an increase in the payout ratio (that is, the numerator) necessarily increase the firm's present value of growth opportunities? Explain. You have been asked by the chief financial officer of your company to estimate what the company's share price will be at the end of four years from today. Your company has recently paid a dividend of $1.00 which is expected to grow at 5% p.a. over the foreseeable future. If the company's required rate of return on equity is 10% your price estimate at the end of year 4 will be closest to: A. $20.00. B. $21.00. C. $24.30. D. $25.50. Follow-up questions 5.1 Given the price at the end of year 4, how would you calculate the price today without using the constant dividend growth model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts