Question: 4. Please show all steps to make the question worth any marks Statement of Cash Flows Below is a list of accounts and post-closing account

4. Please show all steps to make the question worth any marks

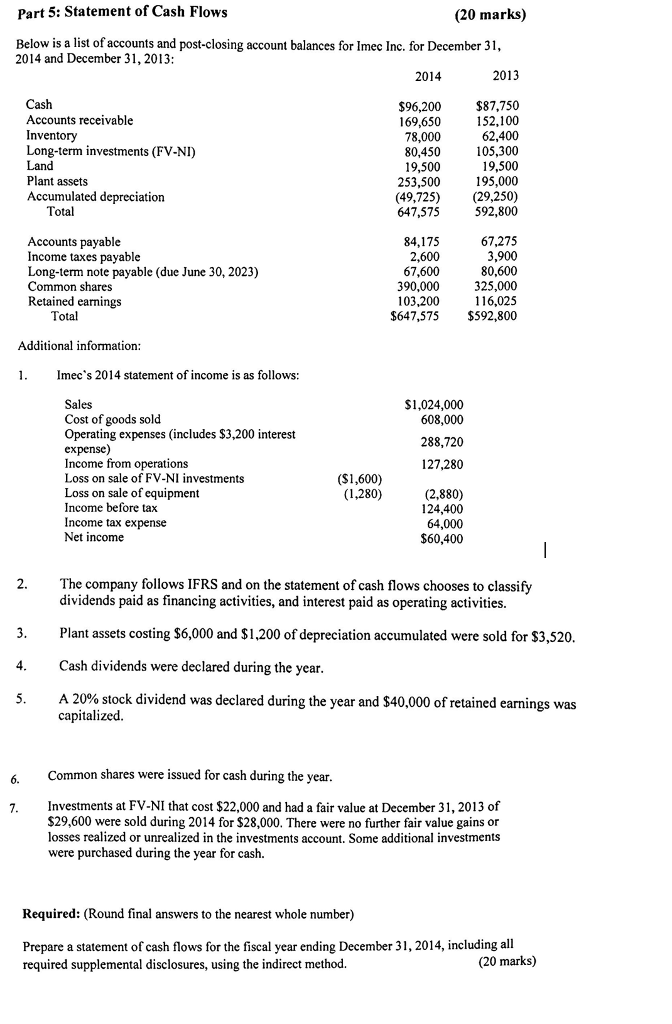

Statement of Cash Flows Below is a list of accounts and post-closing account balances for Idec Inc. for December 31, 2014 and December 31,2013: Cash Accounts receivable Inventory Long-term investments (FV-NI) Land Plant assets Accumulated depreciation Total Accounts payable Income taxes payable Long-term note payable (due June 30, 2023) Common shares Retained earnings Total $1,024,000 608,000 288,720 127,280 (2,880) 124,400 64,000 $60,400 ($1,600) (1,280) Additional information: Idec's 2014 statement of income is as follows: Sales Cost of goods sold Operating expenses (includes $3,200 interest expense) Income from operations Loss on sale of FV-NI investments Loss on sale of equipment Income before tax Income tax expense Net income the company follows IFRS and on the statement of cash flows chooses to classify dividends paid as financing activities, and interest paid as operating activities. Plant assets costing $6,000 and $1,200 of depreciation accumulated were sold for $3,520. Cash dividends were declared during the year. A 20% stock dividend was declared during the year and $40,000 of retained earnings was capitalized. Common shares were issued for cash during the year. Investments at FV-NI that cost $22,000 and had a fair value at December 31,2013 of $29,600 were sold during 2014 for $28,000. There were no further fair value gains or losses realized or unrealized in the investments account. Some additional investments were purchased during the year for cash. (Round final answers to the nearest whole number) Prepare a statement of cash flows for the fiscal year ending December 31, 2014, including all required supplemental disclosures, using the indirect method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts