Question: 4) Please show all workings, let the answers be concise. Problem 4 (5 questions @ 2.5 points each= 12.5%) Questions 22-26 pertain to the following:

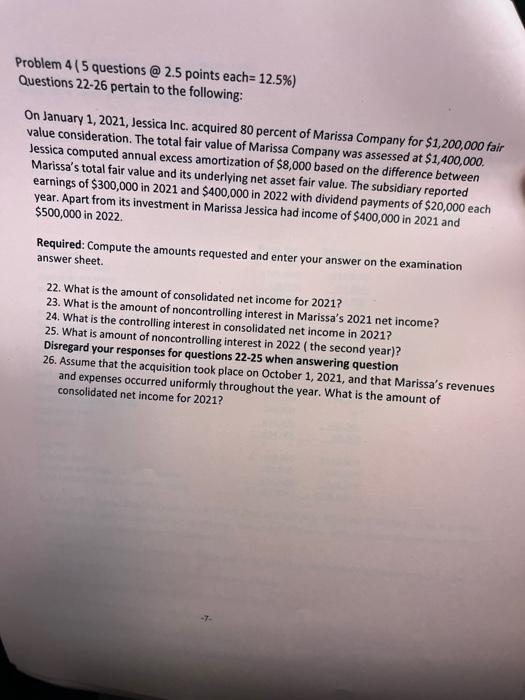

Problem 4 (5 questions @ 2.5 points each= 12.5%) Questions 22-26 pertain to the following: On January 1, 2021, Jessica Inc. acquired 80 percent of Marissa Company for $1,200,000 fair value consideration. The total fair value of Marissa Company was assessed at $1,400,000. Jessica computed annual excess amortization of $8,000 based on the difference between Marissa's total fair value and its underlying net asset fair value. The subsidiary reported earnings of $300,000 in 2021 and $400,000 in 2022 with dividend payments of $20,000 each year. Apart from its investment in Marissa Jessica had income of $400,000 in 2021 and $500,000 in 2022. Required: Compute the amounts requested and enter your answer on the examination answer sheet. 22. What is the amount of consolidated net income for 2021? 23. What is the amount of noncontrolling interest in Marissa's 2021 net income? 24. What is the controlling interest in consolidated net income in 2021? 25. What is amount of noncontrolling interest in 2022 (the second year)? Disregard your responses for questions 22-25 when answering question 26. Assume that the acquisition took place on October 1, 2021, and that Marissa's revenues and expenses occurred uniformly throughout the year. What is the amount of consolidated net income for 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts