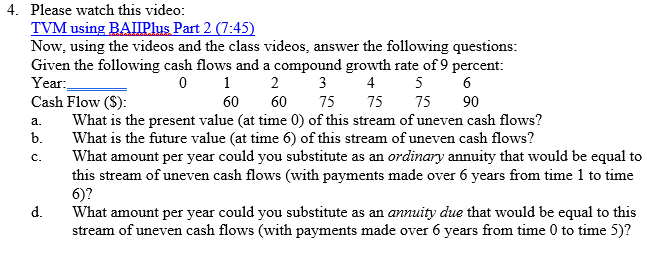

Question: 4. Please watch this video: TVM using BAIIPlus Part 2 (7:45) Now, using the videos and the class videos, answer the following questions: Given the

4. Please watch this video: TVM using BAIIPlus Part 2 (7:45) Now, using the videos and the class videos, answer the following questions: Given the following cash flows and a compound growth rate of 9 percent: Year: 0 1 2 3 4 5 6 Cash Flow ($): 60 60 75 75 75 90 What is the present value (at time 0) of this stream of uneven cash flows? b. What is the future value (at time 6) of this stream of uneven cash flows? What amount per year could you substitute as an ordinary annuity that would be equal to this stream of uneven cash flows (with payments made over 6 years from time 1 to time 6)? d. What amount per year could you substitute as an annuity due that would be equal to this stream of uneven cash flows (with payments made over 6 years from time 0 to time 5)? a. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts