Question: 4. Plot the NPV profile (if you don't know what this is, look it up) of the decision to pay points for the lower

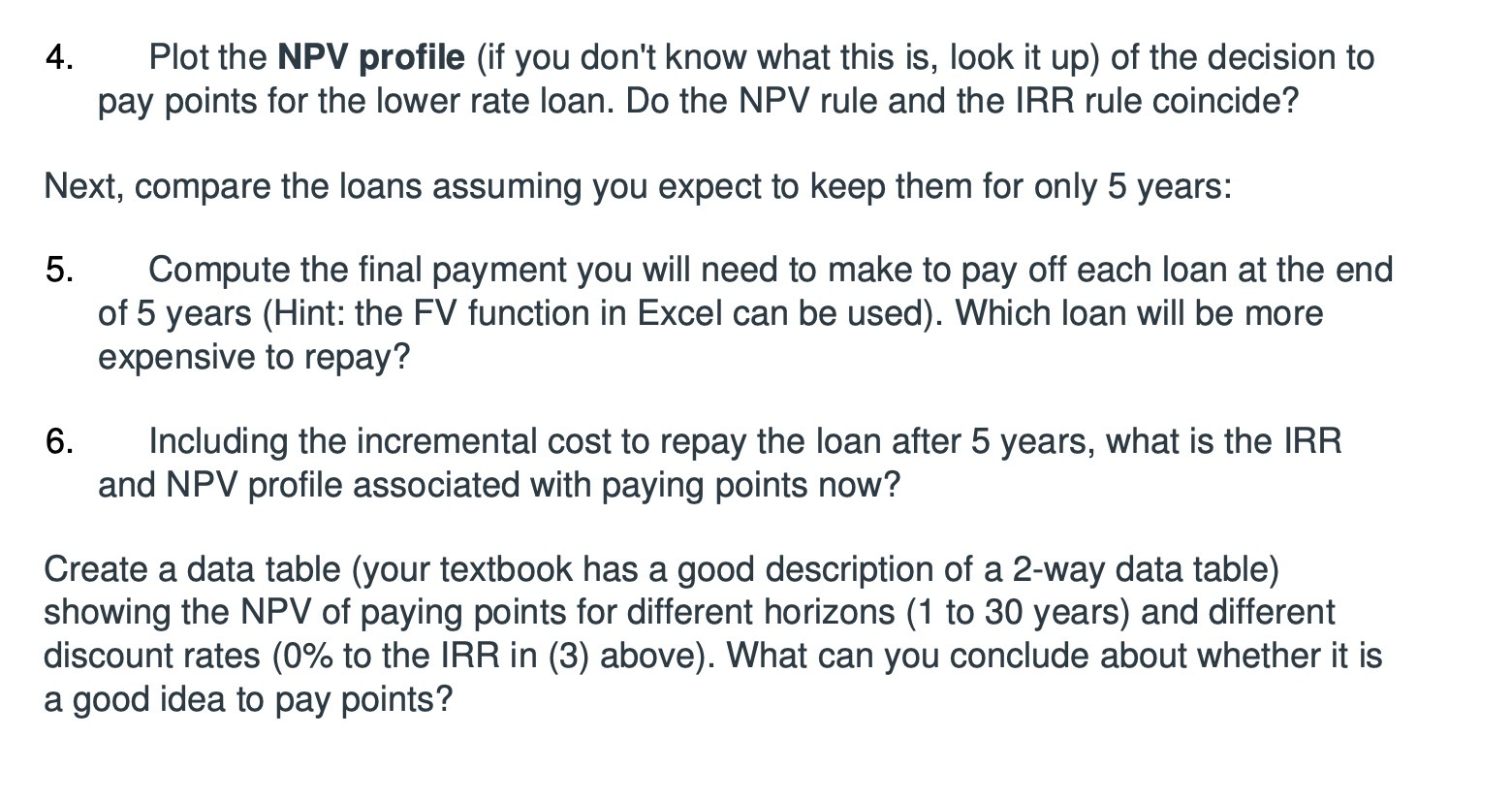

4. Plot the NPV profile (if you don't know what this is, look it up) of the decision to pay points for the lower rate loan. Do the NPV rule and the IRR rule coincide? Next, compare the loans assuming you expect to keep them for only 5 years: 5. 6. Compute the final payment you will need to make to pay off each loan at the end of 5 years (Hint: the FV function in Excel can be used). Which loan will be more expensive to repay? Including the incremental cost to repay the loan after 5 years, what is the IRR and NPV profile associated with paying points now? Create a data table (your textbook has a good description of a 2-way data table) showing the NPV of paying points for different horizons (1 to 30 years) and different discount rates (0% to the IRR in (3) above). What can you conclude about whether it is a good idea to pay points?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts