Question: 4 points Save Answer Derniralp, Inc., is planning to set up a new manufacturing plant in New York to produce auto tracking camera. The company

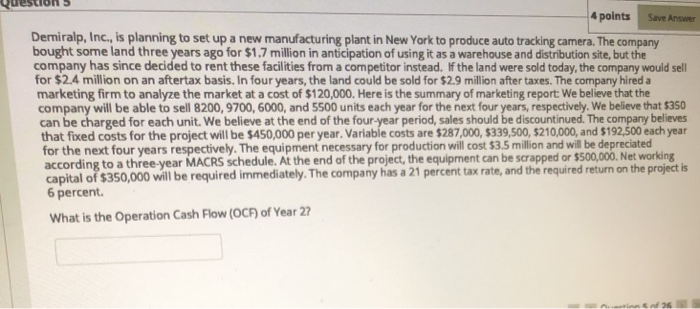

4 points Save Answer Derniralp, Inc., is planning to set up a new manufacturing plant in New York to produce auto tracking camera. The company bought some land three years ago for $1.7 million in anticipation of using it as a warehouse and distribution site, but the company has since decided to rent these facilities from a competitor instead. If the land were sold today, the company would sell for $2.4 million on an aftertax basis. In four years, the land could be sold for $2.9 million after taxes. The company hired a marketing firm to analyze the market at a cost of $120,000. Here is the summary of marketing report We believe that the company will be able to sell 8200, 9700, 6000, and 5500 units each year for the next four years, respectively. We believe that $350 can be charged for each unit. We believe at the end of the four-year period, sales should be discountinued. The company believes that fixed costs for the project will be $450,000 per year. Variable costs are $287,000, $339,500, $210,000, and $192,500 each year for the next four years respectively. The equipment necessary for production will cost $3.5 million and will be depreciated according to a three-year MACRS schedule. At the end of the project, the equipment can be scrapped or $500,000. Net working capital of $350,000 will be required immediately. The company has a 21 percent tax rate, and the required return on the project is 6 percent. What is the Operation Cash Flow (OCF) of Year 2? 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts