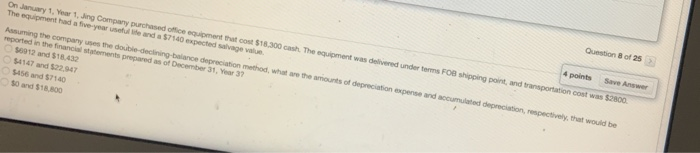

Question: 4 points Save Answer On January 1 Year 1. Jing Company purchased office equipment that cost $18.300 cash. The equipment was delivered under forms FOB

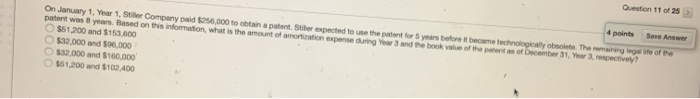

4 points Save Answer On January 1 Year 1. Jing Company purchased office equipment that cost $18.300 cash. The equipment was delivered under forms FOB shipping point and transportation cost was $2800 The equipment had a five-year stude and a $7140 expected salvage value Assuming the company uses the double-declining balance depreciation method, what are the amounts of depreciation expense and accumulated depreciation, respectively, that would be reported in the financial statements prepared as of December 31, Year 37 56012 and $18.432 54147 and 522 947 $450 and $7140 50 and $18.800 Question of 25 4 points over of the e ectively On January 1. Year 1. Stiller Company paid $56.000 to obtain a partir expected to use the patent for 5 years before it became technologically bolt Them part was 8 years. Based on this information, what is the amount of amortization expense during and the book of the parents of December 31, Year 3 r $51.200 and $153.600 $32,000 and 506,000 $32.000 and $160.000 $61,200 and $102,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts