Question: 4. Problem 10.04 Click here to read the eBook: The Cost of Retained Earnings, rs Click here to read the eBook: Cost of New Common

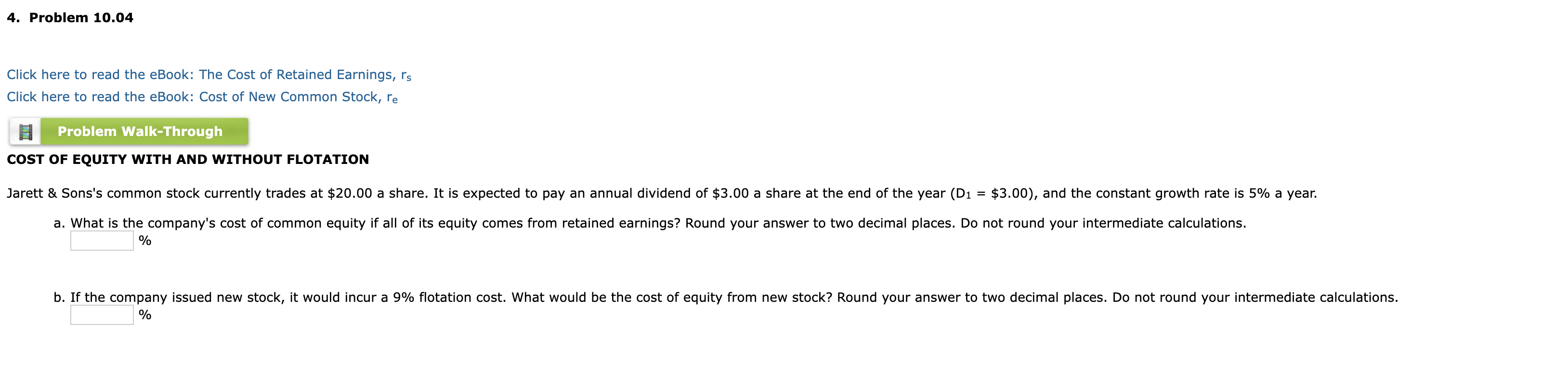

4. Problem 10.04 Click here to read the eBook: The Cost of Retained Earnings, rs Click here to read the eBook: Cost of New Common Stock, re Problem Walk-Through COST OF EQUITY WITH AND WITHOUT FLOTATION Jarett & Sons's common stock currently trades at $20.00 a share. It is expected to pay an annual dividend of $3.00 a share at the end of the year (D1 = $3.00), and the constant growth rate is 5% a year. a. What is the company's cost of common equity if all of its equity comes from retained earnings? Round your answer to two de % nal places. Do not round your intermediate Iculations. b. If the company issued new stock, it would incur a 9% flotation cost. What would be the cost of equity from new stock? Round your answer to two decimal places. Do not round your intermediate calculations. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts