Question: 4. Problem 13-08 eBook Problem 13-08 Compute the Macaulay duration under the following conditions: a. A bond with a four-year term to maturity, an 8%

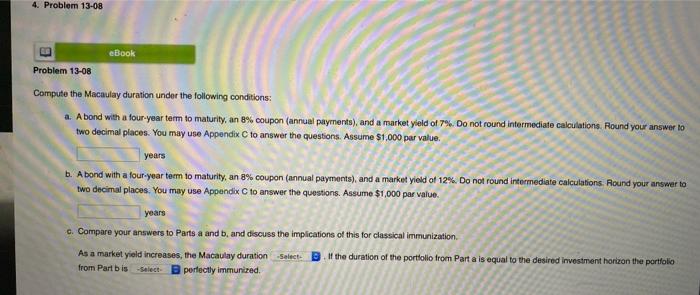

4. Problem 13-08 eBook Problem 13-08 Compute the Macaulay duration under the following conditions: a. A bond with a four-year term to maturity, an 8% coupon (annual payments), and a market yield of 7%. Do not round intermediate calculations. Round your answer to two decimal places. You may use Appendix C to answer the questions. Assume $1,000 par value. years b. Abond with a four-year term to maturity, an 8% coupon (annual payments), and a market yield of 12%. Do not round intermediate calculations. Round your answer to two decimal places. You may use Appendix C to answer the questions. Assume $1,000 par value. years c. Compare your answers to Parts a and b, and discuss the implications of this for classical Immunization As a market yield increases, the Macaulay duration -Select- DIf the duration of the portfolio from Partais equal to the desired investment horizon the portfolio from Part bis Select B perfectly immunized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts