Question: 4 Problem #4: John Wiggins is contemplating the purel listed by the seller is $600,000. John has used past fin cash flows (cash inflows less

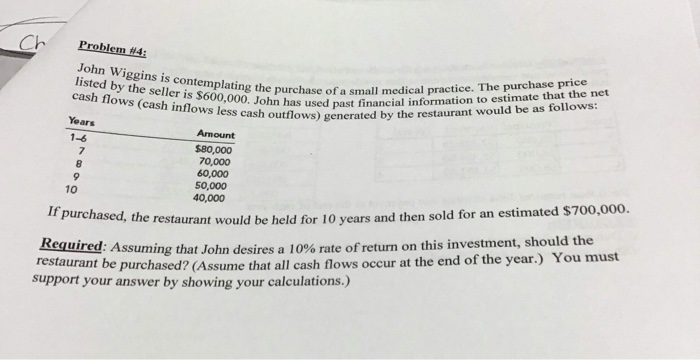

Problem #4: John Wiggins is contemplating the purel listed by the seller is $600,000. John has used past fin cash flows (cash inflows less cash outflows ng the purchase of a small medical practice. The purchase price used past financial information to estimate that the net sh outflows) generated by the restaurant would be as follows: Years 1-6 Amount $80,000 70,000 60,000 50,000 40,000 If purchased, the restaurant would be held ne restaurant would be held for 10 years and then sold for an estimated $700,000. Wed: Assuming that John desires a 10% rate of return on this investment, should the restaurant be purchased? (Assume that all cash flows occur at the end of the year.) You must support your answer by showing your calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts