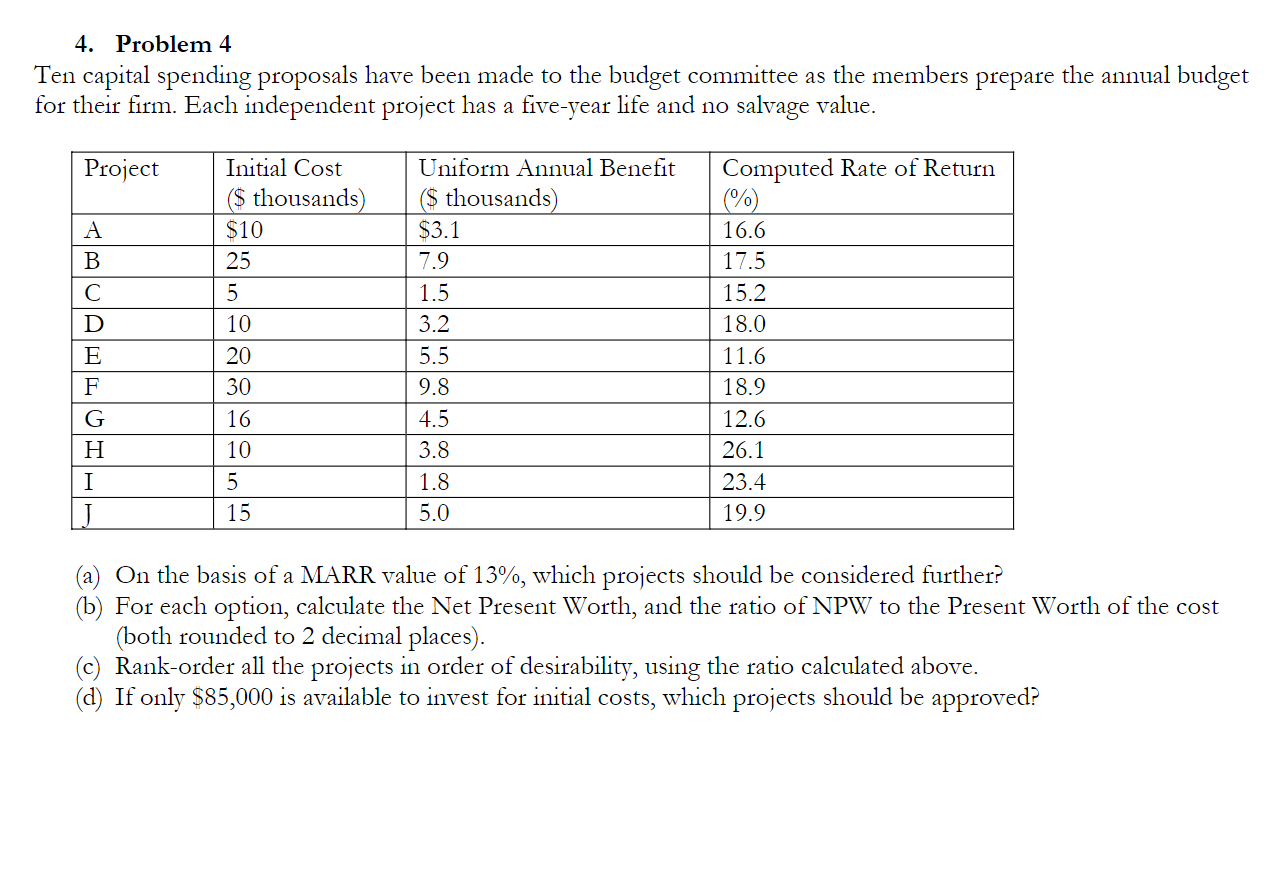

Question: 4. Problem 4 Ten capital spending proposals have been made to the budget committee as the members prepare the annual budget for their firm. Each

4. Problem 4 Ten capital spending proposals have been made to the budget committee as the members prepare the annual budget for their firm. Each independent project has a five-year life and no salvage value. Project Computed Rate of Return Initial Cost ($ thousands) Uniform Annual Benefit ($ thousands) (%) 16.6 $10 $3.1 25 7.9 17.5 5 1.5 15.2 10 3.2 18.0 20 5.5 11.6 30 9.8 18.9 16 4.5 12.6 H 10 3.8 26.1 I 5 1.8 23.4 J 15 5.0 19.9 On the basis of a MARR value of 13%, which projects should be considered further? (b) For each option, calculate the Net Present Worth, and the ratio of NPW to the Present Worth of the cost (both rounded to 2 decimal places). Rank-order all the projects in order of desirability, using the ratio calculated above. (d) If only $85,000 is available to invest for initial costs, which projects should be approved? ABCDEFGE 4. Problem 4 Ten capital spending proposals have been made to the budget committee as the members prepare the annual budget for their firm. Each independent project has a five-year life and no salvage value. Project Computed Rate of Return Initial Cost ($ thousands) Uniform Annual Benefit ($ thousands) (%) 16.6 $10 $3.1 25 7.9 17.5 5 1.5 15.2 10 3.2 18.0 20 5.5 11.6 30 9.8 18.9 16 4.5 12.6 H 10 3.8 26.1 I 5 1.8 23.4 J 15 5.0 19.9 On the basis of a MARR value of 13%, which projects should be considered further? (b) For each option, calculate the Net Present Worth, and the ratio of NPW to the Present Worth of the cost (both rounded to 2 decimal places). Rank-order all the projects in order of desirability, using the ratio calculated above. (d) If only $85,000 is available to invest for initial costs, which projects should be approved? ABCDEFGE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts