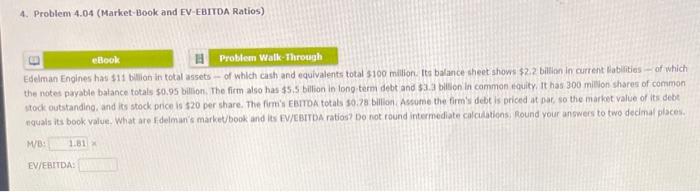

Question: 4. Problem 4.04 (Market-Book and EV EBITDA Ratios) etlook Problem Walk Through Edelman Engines has $11 billion in total assets of which cash and equivalents

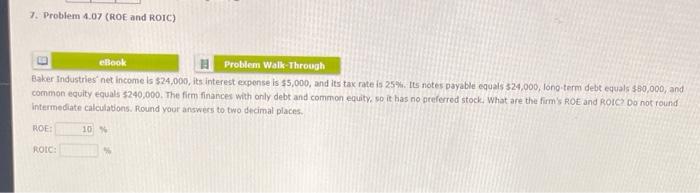

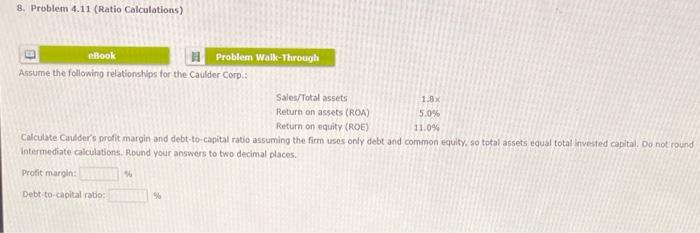

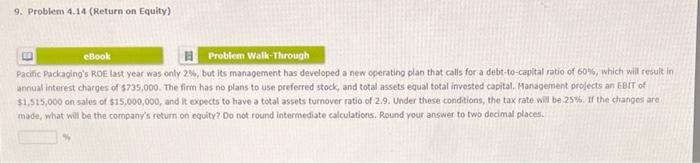

4. Problem 4.04 (Market-Book and EV EBITDA Ratios) etlook Problem Walk Through Edelman Engines has $11 billion in total assets of which cash and equivalents total 100 million Its balance sheet shows $2.2 billion in current abilities of which the notes payable balance totals $0.95 billion. The firm also has $5.5 billion in long term debt and $2.3 billion in common guity. It has 300 million shares of common stock outstanding, and its stock price is $20 per share. The firm's EBITDA totals 50,28 billion Assume the firm's debt is priced at par, so the market value of its debe equals its book value. What are fidelmar's market book and its fV/EBITDA ratios? Do not found intermediate calculations, Round your answers to two decimal places. MB: 1.81 EV/EBITDA 7. Problem 4.07 (ROE and ROIC) ehtook Problem Walk-Through Baker Industries net income is $24,000, its interest expense is $5,000, and its tax rate is 25%. Its notes payable equals 324,000, long-term debt equals $50,000, and common equity equals $240,000. The firm finances with only debt and common equity, so it has no preferred stock. What are the firm's ROE and ROIC? Do not round Intermediate calculations. Round your answers to two decimal places ROE 10 ROIC 3. Problem 4.11 (Ratio Calculations) eBook Problem Walk-Through Assume the following relationships for the Caulder Corp.: Sales/Total assets 1.8% Return on assets (ROA) 5.0% Return on equity (ROE) 11.09 Calculate Coulder's profit margin and debt-to-capital ratio assuming the firm usos only debt and common equity, so total assets equal total invested capital. Do not round Intermediate calculations. Round your answers to two decimal places PHONG TINH CH Debt-to-capital ratio: 9. Problem 4.14 (Return on Equity) eBook Problem Walk-Through Pacific Packaging's ROE last year was only 2%, but its management has developed a new operating plan that calls for a debt-to-capital ratio of 60%, which will result in annual interest charges of 5735,000. The firm has no plans to use preferred stock, and total assets equal total invested capital Management projects an EBIT of $1,515,000 on sales of $15,000,000, and it expects to have a total assets turnover ratio of 2.9. Under these conditions, the tax rate will be 25%. If the changes are made, what will be the company's return on equity? Do not round Intermediate calculations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts