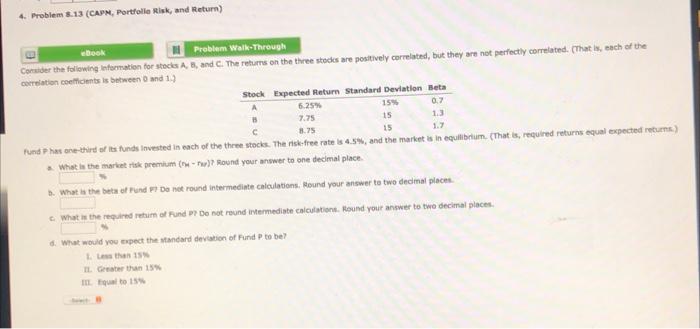

Question: 4. Problem 8.13 (CAPM Portfolie Risk, and Return) book Problem Walk-Through Consider the following information for stocks A, B, and C. The returns on the

4. Problem 8.13 (CAPM Portfolie Risk, and Return) book Problem Walk-Through Consider the following information for stocks A, B, and C. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the correlation coefficients is between 0 and 1.) Stock Expected Return Standard deviation Beta 6.25% 15% 0.2 7.75 15 13 8.75 15 1. Fund Phes one-third of its funds invested in each of the three stocks. The riskfree rates 4.5%, and the market is in equilibrium (That is required returns equal expected returns) What is the market risk premium (? Round your answer to one decimal place 5. What is the beta of Pund Da net round intermediate calculations. Round your answer to two decimal places What is the required retum of Fund P7 De not round Intermediate calculations. Round your answer to two decimal places What would you expect the standard deviation of Fund to be? Its the I Get 15% II Fulto 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts