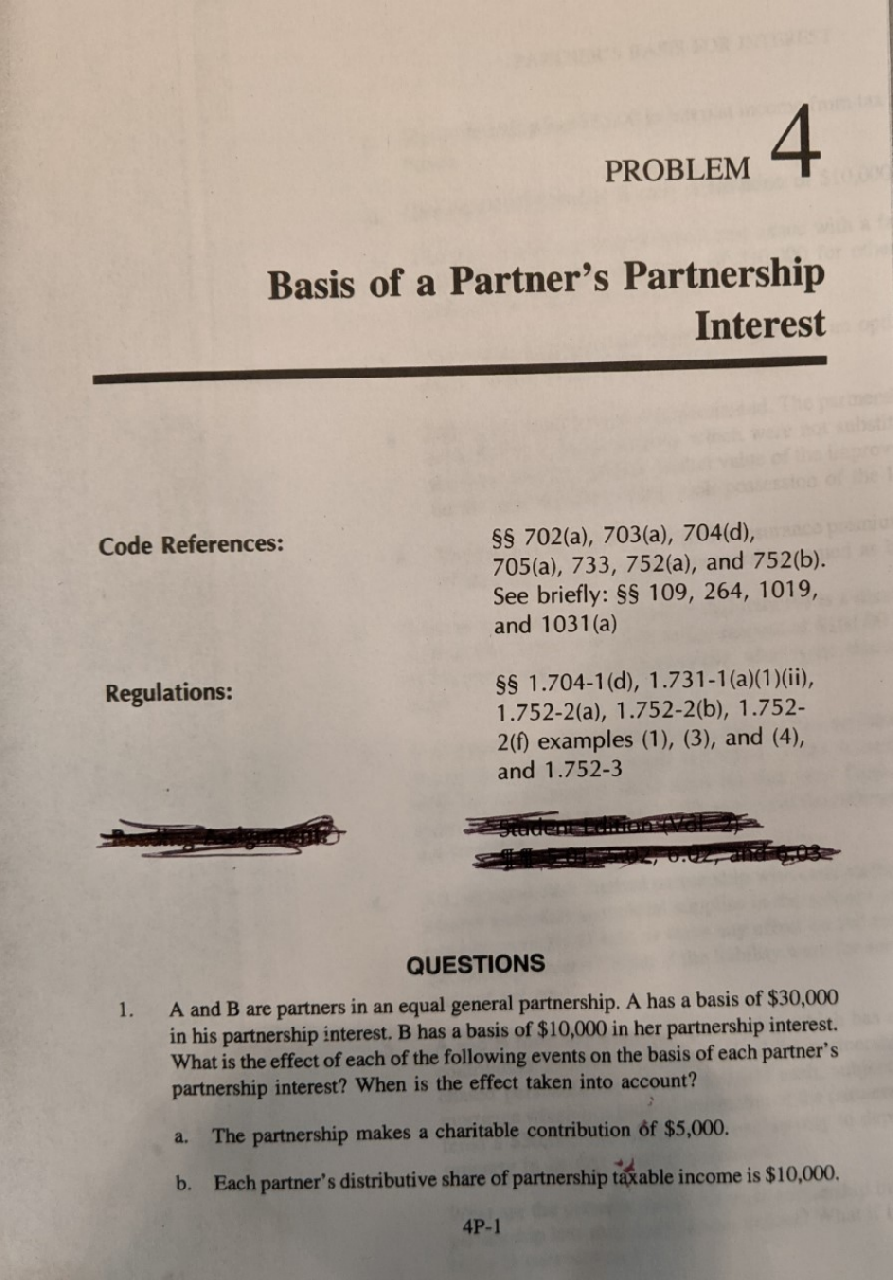

Question: 4 PROBLEM Basis of a Partner's Partnership Interest Code References: SS 702(a), 703(a), 704(d), 705(a), 733, 752(a), and 752(b). See briefly: SS 109, 264, 1019,

4 PROBLEM Basis of a Partner's Partnership Interest Code References: SS 702(a), 703(a), 704(d), 705(a), 733, 752(a), and 752(b). See briefly: SS 109, 264, 1019, and 1031(a) Regulations: SS 1.704-1(d), 1.731-1(a)(1)(ii), 1.752-2(a), 1.752-2(b), 1.752- 2(f) examples (1), (3), and (4), and 1.752-3 tele. QUESTIONS 1. A and B are partners in an equal general partnership. A has a basis of $30,000 in his partnership interest. B has a basis of $10,000 in her partnership interest. What is the effect of each of the following events on the basis of each partner's partnership interest? When is the effect taken into account? a. The partnership makes a charitable contribution of $5,000. b. Each partner's distributive share of partnership taxable income is $10,000, 4P-1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts