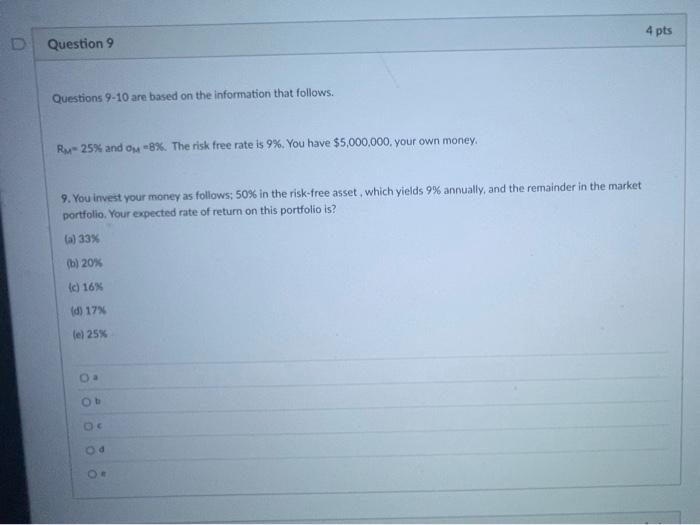

Question: 4 pts D Question 9 Questions 9-10 are based on the information that follows. R- 25% and om -8%. The risk free rate is 9%.

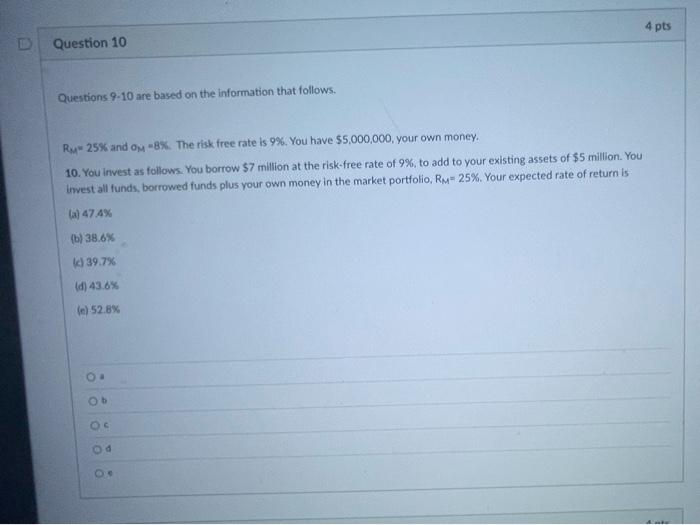

4 pts D Question 9 Questions 9-10 are based on the information that follows. R- 25% and om -8%. The risk free rate is 9%. You have $5,000,000. your own money, 9. You invest your money as follows: 50% in the risk-free asset, which yields 9% annually, and the remainder in the market portfolio. Your expected rate of return on this portfolio is? (a) 33% (h) 20% {c) 16% (d) 17 le 25% 4 pts Question 10 Questions 9-10 are based on the information that follows. Ru - 25% and om -8%. The risk free rate is 9%. You have $5,000,000, your own money. 10. You Invest as follows. You borrow $7 million at the risk-free rate of 9%, to add to your existing assets of $5 million. You invest all funds, borrowed funds plus your own money in the market portfolio, R-25%. Your expected rate of return is (a) 47.4% (6) 38.6% 139.7% (d) 43.6% le) 52.8% Ob

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts