Question: 4. Queen Ltd is having a 5-year project which involves launching a new product. The project requires an investment of $2 million in fixed assets.

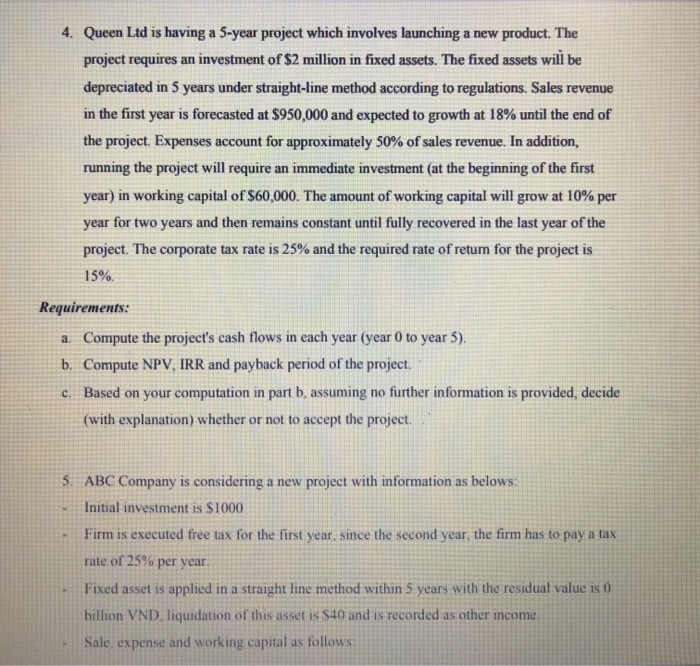

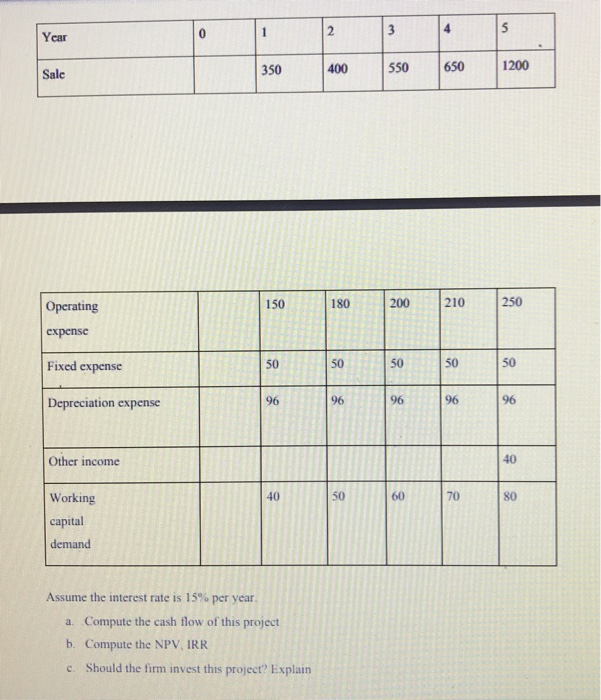

4. Queen Ltd is having a 5-year project which involves launching a new product. The project requires an investment of $2 million in fixed assets. The fixed assets will be depreciated in 5 years under straight-line method according to regulations. Sales revenue in the first year is forecasted at $950,000 and expected to growth at 18% until the end of the project. Expenses account for approximately 50% of sales revenue. In addition, running the project will require an immediate investment (at the beginning of the first year) in working capital of $60,000. The amount of working capital will grow at 10% per year for two years and then remains constant until fully recovered in the last year of the project. The corporate tax rate is 25% and the required rate of retum for the project is 15%. Requirements: a. Compute the project's cash flows in each year (year 0 to year 5). b. Compute NPV, IRR and payback period of the project. c. Based on your computation in part b, assuming no further information is provided, decide (with explanation) whether or not to accept the project. 5. ABC Company is considering a new project with information as belows: Initial investment is $1000 Firm is executed free tax for the first year, since the second year, the firm has to pay a tax rate of 25% per year Fixed asset is applied in a straight line method within 5 years with the residual value is 0 billion VND liquidation of this asset is $40 and is recorded as other income. Sale expense and working capital as follows: 2 0 3 5 Year 350 400 550 Salc 650 1200 150 180 200 210 250 Operating expense Fixed expense 50 50 50 50 50 Depreciation expense 96 96 96 96 96 Other income 40 40 50 60 70 80 Working capital demand Assume the interest rate is 15% per year. a. Compute the cash flow of this project b. Compute the NPV, IRR Should the firm invest this project? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts