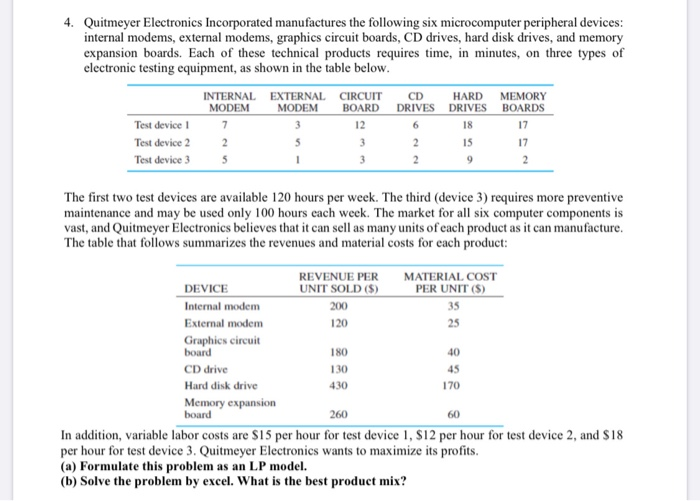

Question: 4. Quitmeyer Electronics Incorporated manufactures the following six microcomputer peripheral devices: internal modems, external modems, graphics circuit boards, CD drives, hard disk drives, and memory

4. Quitmeyer Electronics Incorporated manufactures the following six microcomputer peripheral devices: internal modems, external modems, graphics circuit boards, CD drives, hard disk drives, and memory expansion boards. Each of these technical products requires time, in minutes, on three types of electronic testing equipment, as shown in the table below. INTERNAL EXTERNAL CIRCUIT CD HARD MEMORY MODEM MODEM BOARD DRIVES DRIVES BOARDS Test device 3 12 Test device 2 2 3 17 Test device 3 5 3 2 7 6 17 18 15 2 2 9 The first two test devices are available 120 hours per week. The third (device 3) requires more preventive maintenance and may be used only 100 hours each week. The market for all six computer components is vast, and Quitmeyer Electronics believes that it can sell as many units of each product as it can manufacture. The table that follows summarizes the revenues and material costs for each product: 40 45 REVENUE PER MATERIAL COST DEVICE UNIT SOLD ($) PER UNIT (5) Internal modem 200 35 External modem 120 25 Graphics circuit board 180 CD drive 130 Hard disk drive 170 Memory expansion board 260 60 In addition, variable labor costs are $15 per hour for test device 1, $12 per hour for test device 2, and $18 per hour for test device 3. Quitmeyer Electronics wants to maximize its profits. (a) Formulate this problem as an LP model. (b) Solve the problem by excel. What is the best product mix? 430 XYZ Company has SR 5,000,000 for investment. The company is attempting to determine where its assets should be invested during the current year. The manager of the company is considering four options for investment in market stock, trade credits, personal loans, and bonds. The annual rate of return on each type of investment is known to be: market stock, 15%; trade credits, 22%; personal loans, 14%; and bonds, 28%. To ensure that the company's portfolio is not too risky, the company's investment manager has placed the following three restrictions on the company's portfolio: a. The amount invested in trade credits cannot exceed the amount invested in personal loans. b. At least 45% of the total amount must be invested in market stock c. No more than 25% of the total amount invested may be in bonds. The aim of the company is to maximize the annual return on its investment portfolio. Develop a linear programming model that helps the company to achieve this goal